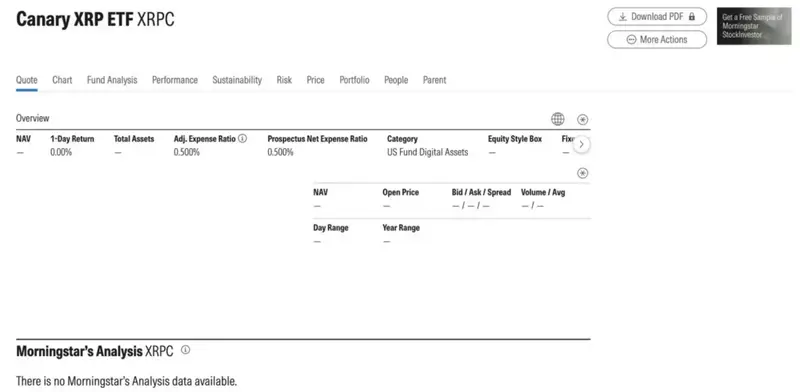

The Nasdaq XRP ETF from Canary Capital got regulatory approval on November 12, 2025, and trading actually started today under the ticker XRPC. This is the first spot XRP ETF available on a US exchange right now. The Canary XRP ETF charges a 0.5% annual fee and gives investors regulated access to XRP through traditional brokerage accounts, which means you don’t have to hold the cryptocurrency directly anymore.

Also Read: See How 1,000 XRP Value Soars Once SEC Approves XRP ETFs

Spot XRP ETF Approval Sparks Nasdaq XRP ETF Launch and Price Surge

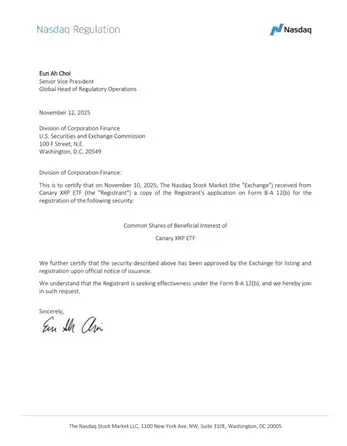

Nasdaq XRP ETF Receives Regulatory Certification

Canary Capital secured this XRP ETF approval using the auto-effective registration process under Section 8(a) of the Securities Act of 1933. The firm filed Form 8-A with the SEC, and this triggered a 20-day automatic approval window unless regulators raised objections.

On November 12, Nasdaq Regulation submitted formal certification to the SEC. The letter confirmed approval for listing and registration of the Canary XRP ETF. According to the certification document, Nasdaq received the registrant’s application on Form 8-A 12(b) on November 10, 2025, and the security “has been approved by the Exchange for listing and registration upon official notice of issuance.”

This cleared the final step for the spot XRP ETF to begin trading as scheduled, which marks a significant shift for XRP as a recognized asset in traditional finance after years of regulatory uncertainty around Ripple and its native token.

Strong Institutional Demand for Spot XRP ETF

The Nasdaq XRP ETF launch follows growing momentum in altcoin investment products that have been gaining traction recently. REX-Osprey’s XRP futures-based ETF generated $24 million in volume within 90 minutes of launching back in September. By October, that fund exceeded $100 million in assets under management, showing strong appetite for XRP investment options even before this spot XRP ETF arrived.

Eleven XRP ETF products now appear on the Depository Trust & Clearing Corporation website, along with filings from major firms such as Bitwise, Franklin Templeton, 21Shares, and CoinShares. This expansion reflects institutional confidence following the SEC’s July 2025 guidance on crypto asset ETPs. The Canary XRP ETF will be traded on the Nasdaq Stock Market and tracks the XRP-USD CCIXber Reference Rate Index.

Also Read: XRP Price Rallies 8% in 24 Hours: How Much Higher Can It Go?

Market Response and XRP Price Prediction

At the time of writing, on-chain data points to ambivalent indicators of the launch of the spot XRP ETF. Glassnode said that over 216 million XRP or about 556 million dollars had left exchanges in the week preceding the announcement which generally reflects a pattern of holding and not trading. But, in reality, whale addresses have dropped their holdings by 10 million XRP within the 2 days to the Nasdaq XRP ETF launch, and this might indicate a bit of profit-taking was occurring. X-Rip was trading around $2.39 in the morning, which is a 0.4 percent drop following the certification announcement.

Other analysts are forecasting that the share prices will be at $5 in Q4 2025, an increase of 108 percent compared to the present price. This relies on the support of institutional inflows to Nasdaq XRP ETF and sustained low exchange supply to carry on. Technical analysis shows that the level at which traders are observing the break out is at $2.88 with the support at $2.31 currently. Trading XRP futures has reflected an open interest at its lowest levels since the beginning of the year by November 12, and this could indicate a low level of interest in taking leverage by the time the Canary XRP ETF was launched.