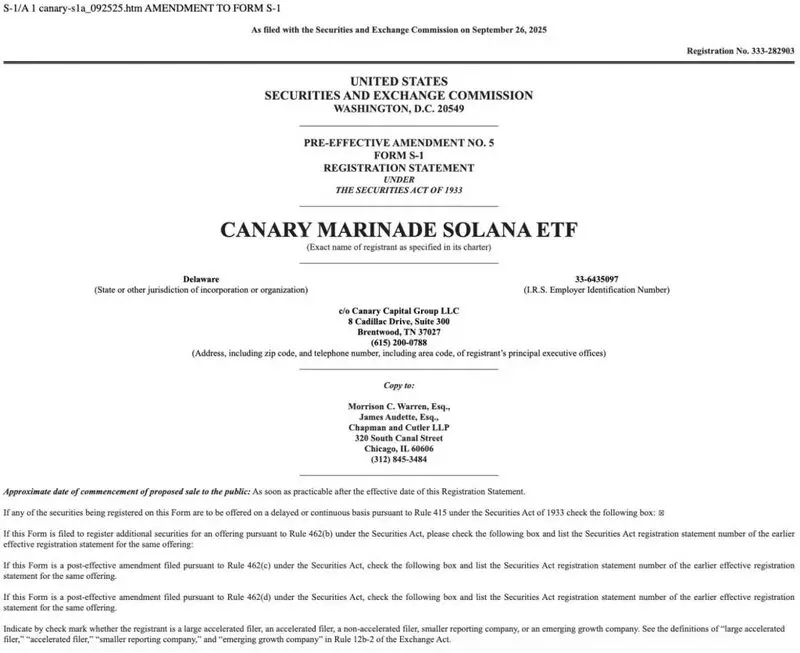

Canary Capital has filed an S1 application to the SEC for a Solana ETF that includes holding and staking SOL tokens. The financial institution first filed for a spot SOL ETF in October of 2024. The latest application aims to amend the previous S1 filing. ETFs have become a hot topic within the crypto landscape. Let’s discuss if the SEC will approve the application in the coming months.

Will The SEC Approve a Solana ETH in 2025?

Cryptocurrency-based ETFs have been in the spotlight over the last year. The US SEC made history in 2024 by approving 11 spot Bitcoin ETFs and 8 spot Ethereum ETFs. ETF inflows have led to both assets hitting new all-time highs in 2025. A Solana (SOL) ETF becoming a reality may be just a matter of time.

The US SEC recently adopted new rules for listing cryptocurrency ETFs. Previously, each crypto ETF had to go through a lengthy and complex approval process. Under the new system, exchanges like the NYSE, Nasdaq, and Cboe can now list crypto ETFs more quickly. The move sheds light on the SEC’s pro-crypto stance.

There is a very high chance that the SEC will approve at least one Solana (SOL) ETF sometime this year. If not in 2025, there is a chance that the financial watchdog will green-light a spot SOL ETF in early 2026.

Also Read: Solana: Steepest Weekly Crash In The Top 10, What’s Happening?

There is a possibility that Solana (SOL) will see increased institutional interest if an ETF is approved. Institutional money is key in driving an asset’s price. SOL could easily hit a new all-time high if it follows Bitcoin’s (BTC) trajectory after a potential ETF launch.

So far, the SEC has yet to pass judgment on the Solana (SOL) ETF applications. How things pan out for the asset is yet to be seen.