Many Wall Street strategists are now betting on European stocks for better returns as the US markets remain unfavorable. The region’s economic outlook is improving while the US is embroiled in trade wars, tariffs, and tit-for-tat policies. JP Morgan wrote in its latest market analysis that European stocks, especially the STOXX Europe 600 (SXXP) index, are poised to outperform the US markets.

Also Read: DigiAsia Unveils $100M Bitcoin Plan, FAAS Stock Surges 91% on Bold Bet

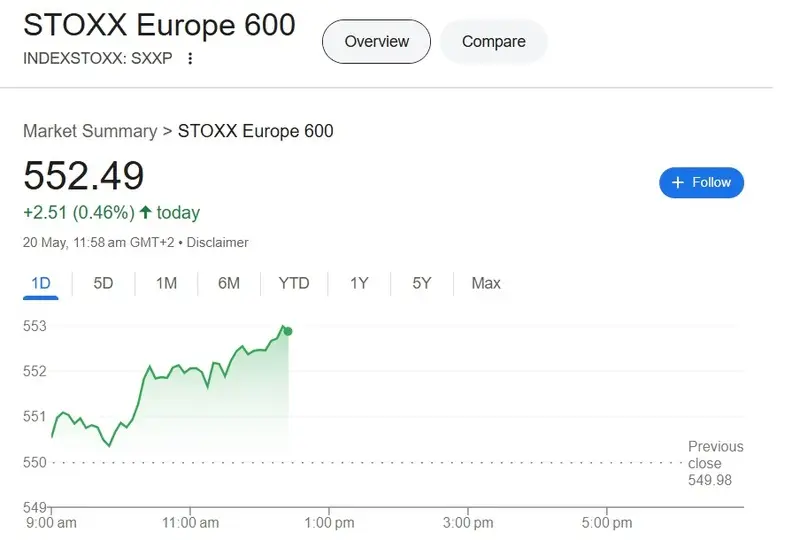

European stocks could put up a good performance and beat the US markets by the most in decades, says JP Morgan. The leading global bank wrote that the next target for the STOXX 600 Europe index is 580. That’s another 5% uptick from here as the SXXP index is currently hovering around the 552 level on Tuesday.

Also Read: Goldman Sachs: MAG7 Hits 7-Year Low Amid AI, Trade & Antitrust Fears

European Stocks More Favorable Than the US Markets: JP Morgan

The European stocks Stoxx 600 index will outperform the S&P 500 index by 25 percentage points in 2025, predicts JP Morgan. This makes investing in STOXX a prime strategy that could deliver better returns than the broader US-based financial assets. While the SXXP index is up more than 8% year-to-date, the S&P 500 index is up only 1.6% YTD.

Also Read: $1,000 in Shiba Inu & XRP: Which Will Give Better Returns in 2030?

Not just JP Morgan, even Citigroup wrote in its latest research piece that European stocks will perform better than the US. Citigroup predicted that STOXX will reach 570 points next, which is an uptick of 3.5%. “If we have already moved past peak earnings uncertainty, this could set the stage for additional upside and potential multiple re-rating, especially among more beaten-up cyclical sectors,” said Citigroup strategist Beata Manthey.

The outlook marks a major turnaround in US financial assets for the first time in decades. Not just European stocks, the inflow of funds into the Chinese markets touched $17.3 billion, reported JP Morgan. The US-based assets are in danger due to tariffs and trade wars, and investors don’t want to risk their portfolios.