The BRICS alliance which kick-started the de-dollarization agenda is now under the mercy of the US dollar in 2025. The US dollar remained in the green for nine consecutive days in the DXY index and tramping other local currencies. The Indian rupee has fallen to a lifetime low of 85.93 and is on the brink of dipping to the 86 level. The Chinese yuan and the Japanese yen are facing similar lows and are unable to take on the rising US dollar.

Also Read: BRICS Makes Huge Announcement on Common Currency

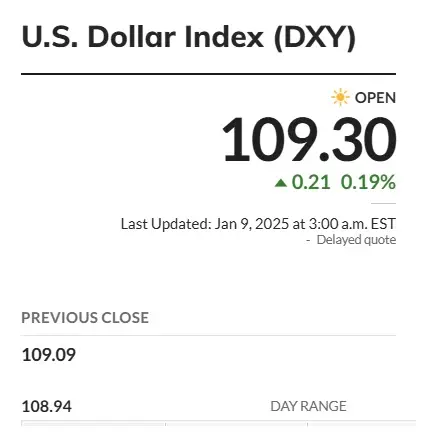

The US dollar singlehandedly outperformed all local currencies in 2025 taking the top spot in the currency markets. The USD has now reached a high of 109.30 in the DXY index and could breach its all-time high of 109.53. The currencies of BRICS members are the hardest hit despite the alliance pushing the de-dollarization agenda to bring the US dollar down.

Also Read: BRICS: India Likely Dumping the U.S. Dollar

BRICS: Here’s Why the US Dollar is Rising and De-Dollarization is Failing

The first boost to the dollar came in early January after US weekly Initial Jobless Claims declined to 201,000 from the previous 211,000. The US Department of Labor (DOL) published the report indicating that the jobs market could ease out leading to employability. In addition, Fed Governor Christopher Waller made an announcement saying that inflation could continue to fall in 2025. These two events early this month boosted the US dollar’s prospects and dented the BRICS’ de-dollarization initiative.

Also Read: India Rejecting BRICS Currency, Aims To Promote US Dollar

The BRICS bloc now remains under pressure as local currencies are facing an uphill task to sustain themselves. The raging US dollar is showing no signs of stopping and is taking the de-dollarization agenda by the horns. If the momentum persists, BRICS can only dream of de-dollarization and never make it a reality. The US dollar has sustained many whiplashes over the last seven decades and has faced all challenges head-on.