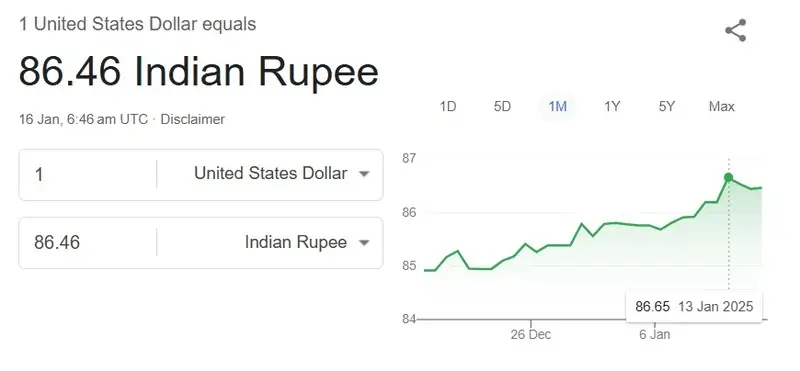

BRICS member India’s local currency rupee is facing heavy pressure from the US dollar in the forex markets in 2025. The INR dipped to an all-time low of 86.65 on Monday and was close to falling to a lifetime low of 87. However, the local currency managed to break the downward spell and briefly surged to 86.46 on Thursday’s opening bell.

Also Read: BRICS: Russia & Myanmar to Trade In Local Currency, Ditch US Dollar

India is accused of intervention in the currency markets to keep the rupee from crashing against the USD. Reuters reported that the Reserve Bank of India (RBI) directed state-run banks to dump billions worth of US dollars in the currency market to keep the rupee from falling. This is not the first time that BRICS member India has been accused of market intervention to safeguard the rupee.

The country most likely intervened thrice in 2024 and twice in 2025 to protect the rupee from sliding. The BRICS country’s local currency brief correction on Thursday is linked to the state-run banks dumping the US dollar. The RBI seems to be “letting it (USD/INR) move up till bids thin out a little and then stepping in to cap the rise,” said a senior trader to Reuters.

Also Read: De-Dollarization: 12 Countries Officially Abandon the US Dollar

BRICS: India Worried a Stronger US Dollar Could Lead to Market Disruption

BRICS member India is worried that a stronger US dollar could directly impact the country’s imports and exports sector. The cost of trade shoots up leading to a disruption in prices among the business firms. The burden of the rising costs could eventually be put on the shoulders of citizens and lead to inflation. The cost of daily essentials could rise along with anger against the government by common folks.

Also Read: Analysts Predict the Future of BRICS Currency

Therefore, India is looking to limit the damage to the rupee by dumping the US dollar in the forex markets. Apart from India, the other BRICS member’s local currencies are also plummeting against the US dollar this year. The DXY index, which tracks the performance of the USD breached the 110 mark early this week.