An SEC crypto ban is an infeasible approach, and this has become the undeniable reality right now, and Bloomberg’s Matt Levine actually declares cryptocurrency prohibition is no longer even possible for regulators. The SEC regulation crypto approach must shift from ban attempts to structured oversight, along with marking a pivotal moment where SEC enforcement limits are being acknowledged by top financial analysts.

Matt Levine: “We will ban crypto” is no longer feasible for the SEC, and “we will ignore crypto because it’s not a security so not our problem” is not very attractive for the SEC. The only choice left is “we will regulate crypto, but in a way that you like. pic.twitter.com/hBFXTmMnh5

— Sar Haribhakti (@sarthakgh) August 7, 2025

SEC Crypto Ban Infeasible: Why Regulation, Not Prohibition, Prevails

Levine’s Direct Assessment

Matt Levine had this to say:

“We will ban crypto” is no longer feasible for the SEC, and “we will ignore crypto because it’s not a security so not our problem” is not very attractive for the SEC. The only choice left is “we will regulate crypto, but in a way that you like.”

The Bloomberg columnist’s analysis actually confirms that an SEC crypto ban infeasible strategy has reached its endpoint right now. With cryptocurrency market rules evolving rapidly, and the crypto ban lifted discussions reflect this new regulatory reality that’s been developing.

Also Read: SEC: Crypto Liquid Staking Activities are Not Considered Securities

Regulatory Shift Under Way

The SEC regulation crypto framework is being reshaped as enforcement agencies recognize their SEC enforcement limits. Traditional prohibition methods have actually been proven ineffective against decentralized networks and widespread adoption that’s happening.

Levine also stated:

”The SEC has experience in investor protection, disclosure, prohibition and making suggestions, but those protections don’t apply to crypto tokens.”

Market Reality Forces Change

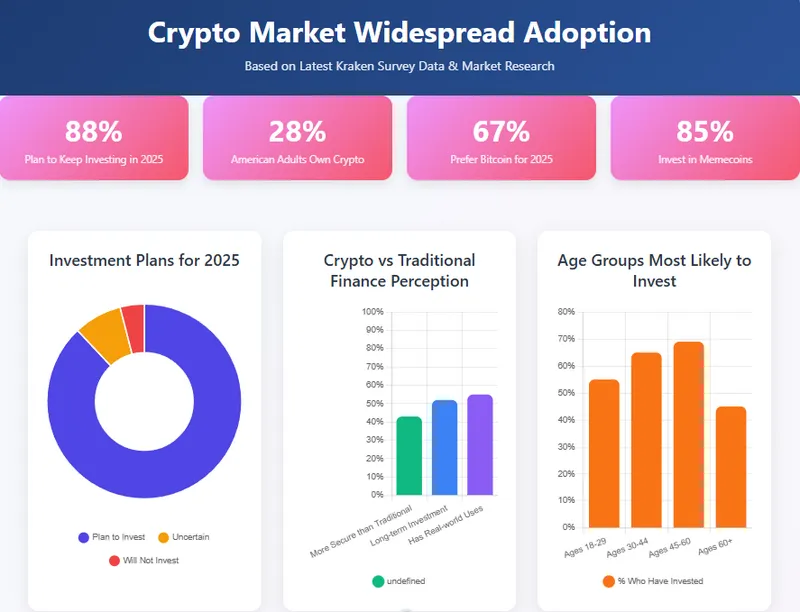

Why an SEC crypto ban infeasible position stems from market forces that regulators actually cannot control right now. Cryptocurrency market rules are being written by adoption rather than prohibition, as millions of Americans now hold digital assets and some major institutions.

Project Crypto represents the agency’s acknowledgment that SEC regulation crypto must replace failed ban attempts. The SEC enforcement limits have been exposed through years of unsuccessful prohibition efforts that were tried.

Levine even emphasized that the crypto ban lifted era reflects practical limitations rather than policy preferences. The “ship has sailed” comment captures how an SEC crypto ban infeasible approach has given way to regulatory adaptation right now.

Also Read: Bernstein: SEC’s Project Crypto Could Rewrite All Wall Street Rules

The shift from SEC crypto ban infeasible tactics to workable cryptocurrency market rules signals a fundamental change in regulatory approach, as authorities accept that prohibition is actually no longer a viable option.