Block’s Q2 earnings in 2025 actually showed some pretty strong performance, and Jack Dorsey bitcoin strategy has been driving around 14% year-over-year profit growth to $2.54 billion right now. The company also raised its Block stock forecast amid Cash App profit growth and even Square AI tools expansion.

AI Tools, Bitcoin Strategy, and Cash App Growth Drive Block Stock Forecast

Right now, Block’s Q2 earnings in 2025 have been revealing multiple growth drivers across the company’s business. Square AI tools actually helped accelerate product development, and along with that, Jack Dorsey bitcoin strategy continued with some 108 BTC added to holdings, bringing total bitcoin reserves to 8,692 BTC.

Cash App profit growth has reached about 16% with $1.50 billion in gross profit, which actually exceeded what analysts were expecting. The peer-to-peer payment platform was showing increased customer engagement, even though economic headwinds have been affecting discretionary spending.

Finance chief Amrita Ahuja stated:

“We saw a lot in the second quarter that gave us some healthy signs, some real encouragement around the products that are the key drivers of growth for us and the key drivers of acceleration in the second half. And that’s what gave us the conviction to raise our guidance.”

Strong Financial Results Drive Some Optimism

Block Q2 earnings 2025 actually included around $538.46 million in net income attributable to common stockholders, compared to $195.27 million in the same period last year. The Jack Dorsey bitcoin strategy faced some challenges though, with a $212.17 million remeasurement loss due to bitcoin’s fair value decrease.

Square AI tools have been contributing to an 11% gross profit increase in the Square segment. The company has been benefiting from faster product releases and also improved team coordination through open-source artificial intelligence implementation.

Also Read: Bitcoin Could Replace The US Dollar In 15 Years, Jack Dorsey Predicts

Market Response and What’s Next

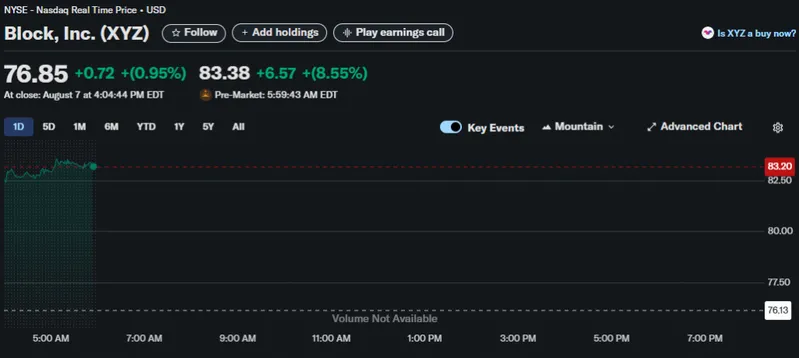

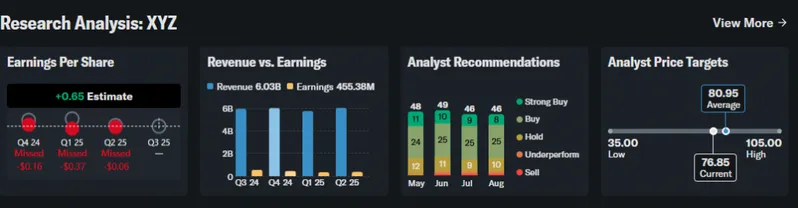

Block stock forecast improvements actually led to shares jumping around 6% in after-hours trading. The company raised its 2025 gross profit guidance to $10.17 billion from $9.96 billion previously, which was announced right after the earnings.

CFO Ahuja noted about market share gains:

“We believe that we’re returning to taking share again across the Square business.”

Cash App profit growth continues as a key driver right now, and Square AI tools have been enhancing operational efficiency. The Jack Dorsey bitcoin strategy remains focused on long-term value creation, even with some quarterly volatility.

Block Q2 earnings 2025 positioned the company pretty well for continued growth in the second half of the year, and the raised guidance reflects management confidence across all business segments.

Also Read: Parataxis Raises $640M in SPAC Merger to Power Bitcoin Treasury