BlackRock’s Panama Canal takeover is currently making waves in financial circles, as the investment giant has just recently secured control of key shipping assets in a massive $22.8 billion deal. This acquisition, finalized just last month, essentially gives the world’s largest asset manager unprecedented control over what many consider to be a vital global trade chokepoint.

Also Read: SEC Acknowledges Dogecoin ETF as Analyst Predicts $1.05 Price By June

How BlackRock’s $22.8B Panama Canal Deal Shifts Global Trade

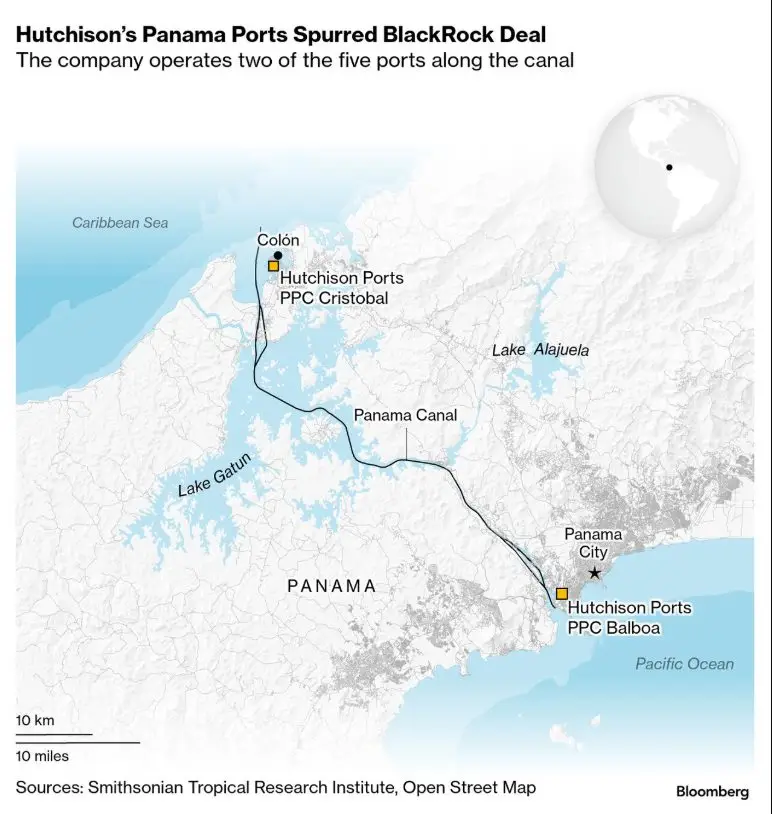

The BlackRock Panama Canal takeover includes, among other things, operational control of major container terminals and also various logistics networks that are absolutely essential to international commerce. This Panama Canal ports acquisition was executed through BlackRock’s Global Infrastructure Partners division, which has been quite active in recent years.

Strategic Implications for Global Trade

A $22.8 billion purchase by BlackRock goes far beyond a mere financial transaction to acquire tangible physical assets that are delivering consistent returns at this point in particular, in the midst of the present chaos in the global economy. The Panama Canal ports acquisition impacts about 6% of the world maritime trade, which, needless to say, is a rather large percentage.

U.S. Senator Marco Rubio expressed concern about the BlackRock Panama Canal takeover, stating:

“Critical infrastructure of hemispheric importance is being concentrated in the hands of a single financial entity with extensive ties to Chinese markets.”

The BlackRock Panama Canal takeover, it turns out, actually involved some pretty direct political maneuvering, with CEO Larry Fink personally picking up the phone to call President Trump right after his inauguration speech about, well, “taking back” the canal. Bloomberg has recently reported that Fink essentially pitched the acquisition as a way of shifting the ports to American control without having to use force or anything like that.

The massive $22.8 billion deal apparently kept both Treasury Secretary Bessent and also Secretary Rubio pretty well informed throughout the whole process, basically aligning BlackRock’s global infrastructure power play with the current administration’s “America First” agenda at this point in time.

Economic Impact on Regional Markets

The BlackRock geoeconomic strategy has, at the time of writing, raised quite a few concerns about potential shipping cost increases. Panama’s government has, however, defended the global infrastructure power play, citing various modernization commitments and such.

A BlackRock spokesperson responded to concerns about the Panama Canal ports acquisition:

“Our investment in Panama’s port infrastructure represents a long-term commitment to enhancing global trade efficiency while maintaining the neutrality and accessibility that has made the Canal a cornerstone of international commerce.”

Also Read: Ethereum Continues Upswing: ETH To $3000 This Week?

Future Infrastructure Investment Trends

The BlackRock Panama Canal takeover signals, among other things, broader ambitions in the global infrastructure sector. Industry experts and analysts alike suggest this BlackRock geoeconomic strategy may well include acquiring additional transportation hubs worldwide in the near future.

Morgan Stanley infrastructure analyst James Peterson noted:

“This transaction represents a fundamental shift in how critical trade infrastructure is owned and operated. BlackRock is positioning itself not just as an investor but as a gatekeeper to global commerce.”

The $22.8 billion deal essentially points out the manner in which private capital is coming to cover the infrastructure gaps as the government is under debt and fiscal pressure. The global infrastructure power play, for many experts in the field, brings a number of concerns regarding the balance of the public interest and profit motives in the future.

Also Read: Bitcoin: AI Sets BTC’s Price If Trump Eliminates Taxes On Crypto