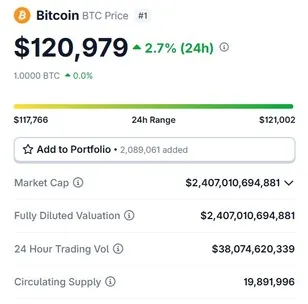

BTC hit a new all-time high of $120,980 early Monday and is attracting heavy bullish sentiments. Bitcoin skyrocketed in July 2025 and is on a steady upward trajectory. Investors who took an entry position in BTC a year ago are all in profit and could earn more. Institutional money has been pouring into cryptocurrency and has helped its price to soar to a new ATH.

The latest prediction from the Finder’s panel of financial experts indicates that Bitcoin could end 2025 at $145,000. That’s another 21% uptick from today and a double-digit return to investors in less than six months. Therefore, an investment of $10,000in BTC today could turn into $12,100 by the end of the year.

Also Read: Strategy (MSTR) Stock Aligns with Bitcoin Boom, Surges 6%

A Rally Expected For Bitcoin in 2025

Bitcoin is expected to pick up speed in 2025 and remain on the greener side of the spectrum. The Finder’s outlook for BTC is bullish and taking an entry position at its all-time high of $120,980 is beneficial. The king cryptocurrency could see a few dips along the way but is on track to head north, read the forecast. If BTC soars, other leading altcoins like Ripple’s XRP, Cardano’s ADA, and VeChain’s VET could also rally in the charts.

Also Read: $1,000 in Gold vs Bitcoin: Which Made You Richer by 2030?

The panel includes notable industry voices such as Miles Paschini, CEO of FV Bank. Simon Peters, Market Analyst at eToro, and Joseph Raczynski, Futurist, JT Consulting & Media. “The integration of Bitcoin into traditional finance and its adoption by institutional investors is accelerating (in 2025),” said Ruslan Lienkha, Chief of Markets at YouHodler,

“As a result, the potential capital inflow from investment funds, banks, and both public and private corporate treasuries remains substantial. Furthermore, if Bitcoin continues to gain recognition as a legitimate macroeconomic hedge, it could prompt investors to significantly increase, potentially double or triple, their portfolio allocations to BTC,” he said.