Bitcoin price is significantly down from its earlier ATH of $120K, exploring the low price realms of $88K. The token has crashed below the $90K levels, sweeping the market away in utter despair and panic. While multiple crypto analysts are bullish on the BTC price dip, calling it a mild correction, one leading economist says Bitcoin’s future is grim, with 2026 bringing in more chaos for the asset.

Also Read: Historical Data Shows Bitcoin Volatility Is a Feature, Not a Flaw

Bitcoin Down: Economists Warn Worst Is Yet To Come

Bitcoin’s latest price plunge is the talk of the whole crypto town. The token’s sudden price fall from its earlier ATH of $120K has taken the markets by surprise while compelling investors to rethink their BTC investments and narratives. In addition to this, economist Peter Schiff has once again gained the spotlight for speaking about the recent Bitcoin price fall, adding how the asset is yet to experience its biggest downfall.

Schiff took to X to share details, adding how the asset is on the verge of breaking $88K. The economist added that if the bitcoin price can break the critical level of $88K, it could bring in significant chaos, stating that the asset is down 30% from its earlier high.

The economist further shared an ominous theory, adding how 2026 could prove to be a far worse year for Bitcoin to explore.

“When Bitcoin breaks $88K, you’re going to see some serious shit. Bitcoin’s down nearly 30% from its high in dollars and 42% from its high priced in gold. How many people popping champagne corks at Bitcoin $100K parties a year ago expected 2025 to be this bad? 2026 could be far worse.”

How True Is Schiff’s Claim Per Technical Analysis

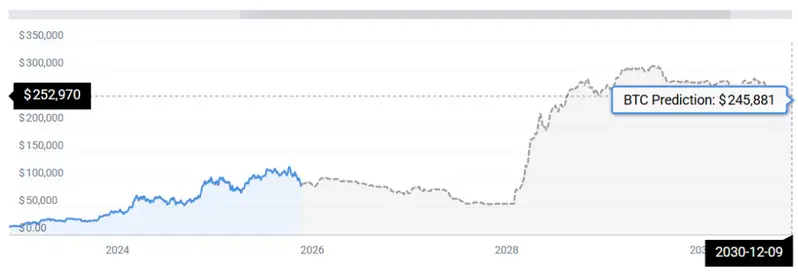

According to CoinCodex BTC stats, 2026 may indeed turn out to be a mellow year for BTC to experience. The Bitcoin price may hit new lows, including $78K by 2026, but the asset is primed to hit $245K latest by 2030.

“According to our latest Bitcoin price prediction, BTC is forecasted to rise by 167.18% and reach $245,881 by December 9, 2030. Per our technical indicators, the current sentiment is bearish, while the Fear & Greed Index is showing 15 (Extreme Fear). Bitcoin recorded 13/30 (43%) green days with 6.30% price volatility over the last 30 days. Last update: Nov 20, 2025 – 06:10 AM (GMT+5).”

Also Read: Why Morgan Stanley Expects Strong S&P Gains Next Year: 2 Reasons