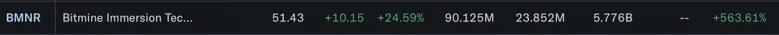

According to Yahoo Finance stocks data, BitMine Immersion Technologies’ stock, BMNR, has seen a massive price spike. The Bitcoin mining stock has risen 24.59% after market hours and 563.61% in the 52-week charts. Let’s discuss whether you should consider buying the stock.

Should You Buy Bitcoin Mining Company Stock?

BitMine recently put out a statement announcing its Ethereum (ETH) holdings. The company started its ETH treasury earlier this year on June 30th. In just over a month, the company has become the largest Ethereum treasury in the world and the third largest crypto treasury. According to the BitMine’s press release, the company has 1,150,263 ETH, worth more than $4.96 billion.

According to BitMine’s Chairman of the Board of Directors, Thomas Lee, “In just a week, BitMine increased its ETH holdings by $2.0 billion to $4.96 billion (from 833,137 to 1.15 million tokens), lightning speed in the company’s pursuit of the ‘alchemy of 5%’ of ETH.“

BitMine stock is currently one of the hottest stocks in the US market. According to Fundstrat, BMNR has seen an average daily volume of about $2.2 billion.

The BTC mining company’s stock could continue to rally over the coming weeks. The rally may have been triggered by the company’s disclosure about its Ethereum (ETH) holdings. Ethereum (ETH) has seen incredible growth over the last few months. The asset began an ascent after its Pectra upgrade. ETH has once again reclaimed the $4,000 price point, a level last traded at in December of last year.

Also Read: 5 Bitcoin Mining Wallets Wake After 15 Years With $29 Million Profit

BitMine’s stock price spike could also be due to BTC inching closer to a new all-time high. The original crypto briefly reclaimed the $122,000 mark earlier today. The asset has since slipped to the $120,000 price level. BTC is down by just 2.2% from its all-time high of $122,838. There is a high chance the asset will climb to a new all-time high very soon.