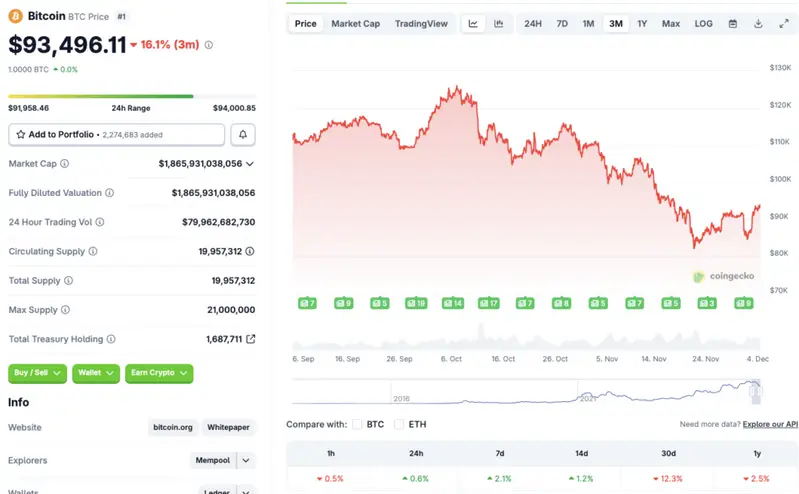

Bitcoin (BTC) entered a bullish phase earlier this week, experiencing a rally to $93,000 on Dec. 3, 2025. However, the asset’s price seems to be consolidating around the $93,000 mark. According to CoinGecko’s Bitcoin data, BTC has rallied 0.6% in the last 24 hours, 2.1% in the last week, and 1.2% in the 14-day charts. The asset has yet to recover on the monthly and yearly charts, with its price falling 12.3% and 2.5%, respectively. Let’s discuss which price level for Bitcoin (BTC) can send the entire crypto market into a bull run.

When Will Bitcoin’s Rally Trigger a Bull Run?

Bitcoin (BTC) is currently facing some resistance at $93,000. Breaking this level could lead to additional resistance at the $103,000-$106,000 level. If Bitcoin (BTC) breaks past $106,000, we see a market-wide rally.

There is a high possibility that Bitcoin (BTC) will go beyond $106,000 in the coming weeks. The Federal Reserve is expected to announce another interest rate cut after its December meeting. Another rate cut will likely lead to a surge in crypto investments.

Futures data also signals investor bullishness. Improvements in futures data were also a catalyst for the recent market upswing.

Moreover, a recent Grayscale report also highlighted that Bitcoin (BTC) may be following a 5-year cycle. This would mean that the asset may hit a new all-time high in 2026. BTC’s journey to a new peak could start over the coming days.

ETF inflows are also expected to take off. ETFs have played a vital role in Bitcoin’s (BTC) rise over the last year. BTC has hit multiple peaks since the SEC approved 11 spot BTC ETFs in early 2024.

Also Read: BlackRock Says US National Debt will Accelerate Crypto Adoption

However, despite the bullish possibilities, the crypto realm is plagued by volatility. Macroeconomic conditions could present unforeseen challenges, and Bitcoin (BTC) could face another correction. Otherwise, the original crypto could also enter a prolonged consolidation phase.