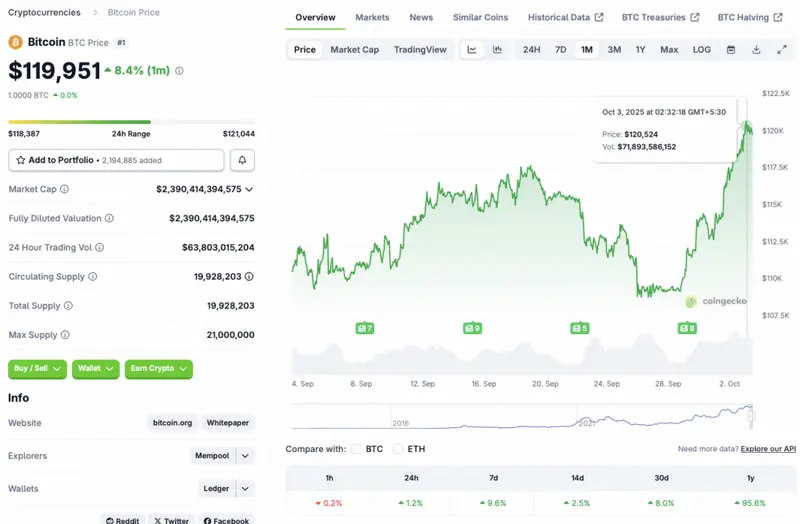

Bitcoin (BTC) reclaimed the $120,000 price point earlier today and is facing some resistance at this level. BTC has made quite a quick recovery from its recent descent to the $109,000 price level. According to CoinGecko data, Bitcoin (BTC) has rallied 1.2% in the last 24 hours, 9.6% in the last week, 2.5% in the 14-day charts, 8% in the previous month, and 95.6% since October 2024. In this price prediction article, let’s discuss if Bitcoin can breach a new peak of $130,000 over the coming weekend.

Bitcoin Price Prediction: $130,000 Over This Weekend?

While September has historically been a bearish month for Bitcoin (BTC), October has been the opposite. Many even call October “Uptober,” highlighting its bullish history. BTC could see its rally continue over the coming days if we follow the historical pattern. If BTC breaches the $125,000 mark, it could climb further to hit $130,000. However, whether the asset can hit $130,000 this weekend is questionable.

Moreover, there is a very high chance that the Federal Reserve will roll out another 25 basis point interest rate cut this month. Another rate cut could lead to a surge in investor confidence. The move could trigger a spike in risky investments as borrowing becomes even easier. Such a development could cause Bitcoin (BTC) and the larger crypto market to enter another bull run. BTC could hit a new all-time high of $130,000 under such circumstances.

CoinCodex also anticipates Bitcoin (BTC) to breach the $130,000 mark, but not over this coming weekend. The platform predicts Bitcoin (BTC) will trade at $131,606 on Oct. 9. Hitting $131,606 from current price levels will entail a rally of about 9.6%.

Also Read: Metaplanet Adds $600M in Bitcoin, Joins Top 4 Public Holders

While Bitcoin’s (BTC) forecast looks quite bullish, there is always the possibility of economic factors presenting unforeseen challenges. President Trump’s tariffs could lead to economic hurdles that may lead to fresh volatility. Moreover, slow economic growth could lead to the Federal Reserve postponing its interest rate cut.