Bilt mortgage rewards now allow homeowners to actually earn points on mortgage payments, and this is through a groundbreaking partnership between Bilt Rewards and United Wholesale Mortgage. The UWM Bilt partnership was announced on October 14, 2025, and it enables mortgage holders to earn points on what’s typically their largest monthly expense. This program works through the Bilt Card 2.0, and it represents a significant shift in how rewards card benefits are being offered right now.

How Bilt Mortgage Rewards Make Homeownership More Rewarding

The UWM Bilt Partnership Delivers New Benefits

The collaboration between UWM and Bilt Rewards creates an opportunity for homeowners to earn points on their house payments, which is something that hasn’t really been available before. At the time of writing, this represents one of the first times that such a large housing expense can also generate rewards.

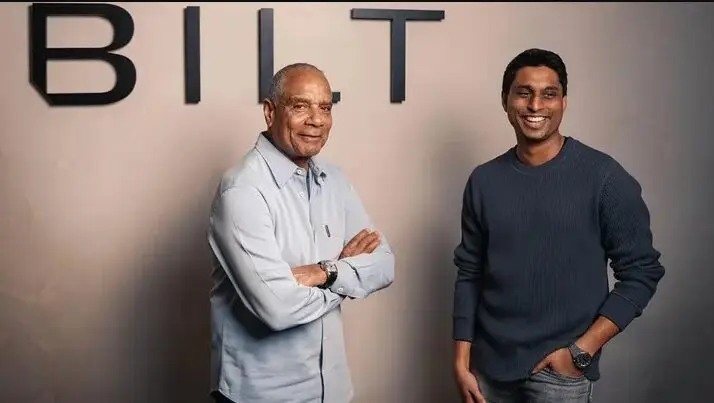

Mat Ishbia, CEO of UWM, had this to say:

“We’re excited to partner with Bilt Rewards to offer our clients an exclusive opportunity to earn points on their mortgage payments. This partnership reflects our commitment to innovation and providing added value to homeowners across the country.”

Ankur Jain, Founder and CEO of Bilt Rewards, stated:

“Homeownership is the largest monthly expense for most Americans, and until now, it’s been an expense that provided no rewards. Through our partnership with UWM, we’re changing that dynamic and making every mortgage payment more valuable.”

Also Read: 30-Year Fixed Mortgage Rates Records Biggest Drop in a Year

How the Bilt Card 2.0 Enables Bilt Mortgage Rewards

The Bilt Card 2.0 serves as the main tool for earning Bilt rewards on housing expenses, along with other purchases. Homeowners can link their UWM mortgages to earn points on mortgage payments, and they can also use the mortgage rewards card for everyday spending too.

The program also allows points to be redeemed for things like travel, fitness memberships, or even future down payments. The UWM Bilt partnership makes mortgage payments rewarding through a system that tracks and awards points automatically.

Eligible UWM borrowers are now transforming their monthly housing costs into valuable, multi-use rewards through this program.

Also Read: Mortgage Fraud Claims Rock Fed: Lisa Cook Hires Abbe Lowell to Fight