Apple stock has actually reached around $211 today amid ongoing tensions between the Trump administration and India regarding manufacturing expansion. At the time of writing, many investors are closely monitoring how currency substitution, United States dollar, and cryptocurrency movements might possibly impact Apple’s global strategy as well as future earnings.

Also Read: Is The Chinese Yuan The New Currency King After the US Dollar?

How Trump-India Tensions Impact Apple Stock, Currency Risks

Apple CEO Tim Cook is now stuck in the middle because President Trump wants Apple to make its products in America, but Apple is also working to spread out its manufacturing around the world. The Trump India situation has certainly created additional uncertainty for Apple stock and various currency markets.

Tim Cook is convinced by the fact that: “Assuming the current global tariff rates, policies, and applications do not change for the balance of the quarter and no new tariffs are added, we estimate the impact to add $900 million to our costs.”

Market Volatility Grows

President Trump’s recent warning against Apple building in India has, in fact, increased market volatility quite significantly. The strengthening United States dollar also complicates Apple’s international revenue streams in several key markets.

Daniel Ives, global head of technology research at Wedbush Securities, noted: “Making iPhones entirely in the U.S. would potentially triple their price to around $3,500.“

Also Read: Shiba Inu Price Prediction: How $10K Could 3.5x and Make You a Whale by 2027

Currency Substitution Impacts

Right now, Apple stock performance seems to reflect growing concerns about currency substitution risks in various markets. Cook’s ongoing supply chain restructuring apparently aims to mitigate Trump-India tariff impacts and the effects of cryptocurrency market fluctuations on the company’s bottom line.

Tim Cook confirmed: “The majority of iPhones sold in the US will have India as their country of origin.”

Future Outlook

Despite these tensions and challenges, Apple has reported rather solid Q1 results with revenue rising about 5% to approximately $95.4 billion. The United States dollar trends and cryptocurrency movements will likely continue influencing Apple stock in the coming months, according to several market observers.

Erik Woodring of Morgan Stanley maintained his “BUY” rating: “Despite near-term pressures from tariffs and supply chain disruption, Apple’s fundamentals remain strong.”

Also Read: Charlie Munger Was Right: A $275 Stock Can Build Your First $100K

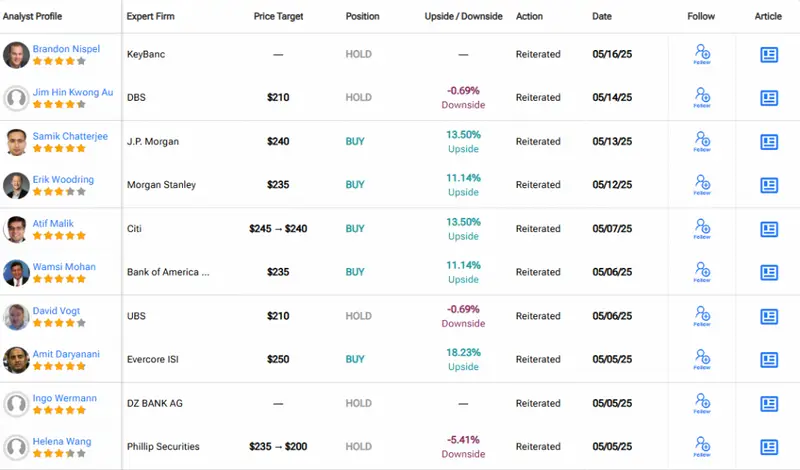

Right now, analysts are still fairly optimistic about Apple, especially since most have given the company a “BUY” rating with a price target of around $228.65 for the next coming year.