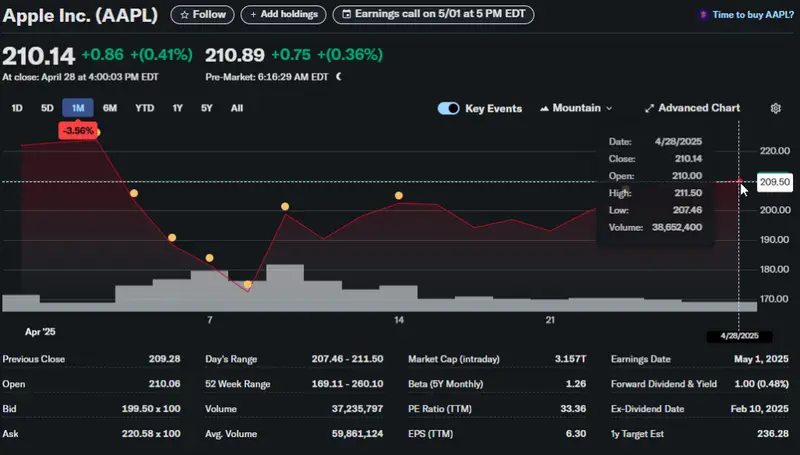

AAPL Q2 earnings are all set to be reported this Thursday right after the market close, with investors and analysts alike watching iPhone demand in China and also keeping an eye on tech stock volatility, especially amid recent news of Apple airlifting about 600 tons of iPhones. At the time of writing, the Apple stock forecast seems to hinge heavily on these upcoming AAPL Q2 earnings as concerns about tariffs continue to loom over the Apple earnings report.

Also Read: Top 5 Defense Stocks to Buy as U.S. Approves $150B Military Budget

iPhone Demand in China and Apple’s Stock Volatility Explored

Yahoo Finance Technology Editor Dan Howley stated:

“Greater China revenue is expected to come in at 16.8 billion. That would actually be an increase from the 16.3 billion in the same quarter last year.”

AAPL Q2 Earnings Expectations

For the highly anticipated AAPL Q2 earnings, analysts are currently projecting an EPS of around $1.62, which is up from $1.53 last year, with total revenue possibly reaching approximately $94.2 billion compared to the $90.7 billion reported previously. However, there are still some persistent concerns about iPhone revenue.

Dan Howley noted:

“Analysts are expecting iPad, Mac and wearable services home, the HomePod, those kinds of products to increase while the iPhone decreases.”

Tech Stock Volatility Factors

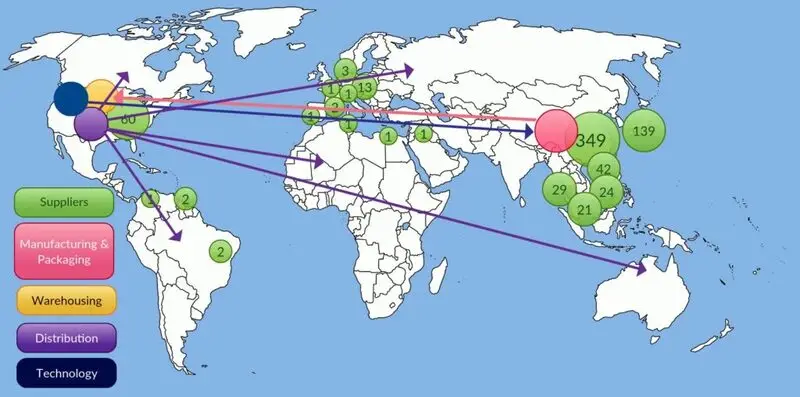

Tech stock volatility may well increase as Apple addresses and tries to manage the impacts of tariffs on their supply chain and operations. The Apple stock forecast will be influenced quite a bit by how the company handles these challenges in the near future.

Also Read: One Cent Dream: ChatGPT Predicts Factors Helping Shiba Inu (SHIB) Hit $0.01

Apple Earnings Report Focus Areas

Apple’s upcoming earnings report will likely detail some manufacturing adjustments they are considering to offset various tariff concerns.

Dan Howley explained:

“We should get some insight as to the manufacturing processes that they may be taking, the steps they may be taking to offset any potential tariffs. So I think moving production to India for US users instead of China. But there’s still a huge amount of production that comes out of China. So they can’t just pick up and move everything to India for US users.”

Consumer Behavior and AAPL Q2 Earnings

The forthcoming AAPL Q2 earnings might also reveal certain changes in consumer purchase patterns due to ongoing tariff concerns, which could potentially affect the Apple stock forecast in several ways.

Howley remarked:

“One of the important things that we’re going to be looking for is whether there’s pull forward from consumers in the last quarter. In other words, whether or not consumers knew the tariffs were coming and decided, well, okay, let’s go get an iPhone now so we don’t have to potentially pay more.”

Also Read: Pi Network Price Prediction: Analysts Eye 3x Rally to $1.70 For Mid-May 2025

The upcoming AAPL Q2 earnings call on Thursday will provide some crucial insights for investors who are currently assessing tech stock volatility and also trying to understand the Apple earnings report implications for the remainder of 2025.