Apple (AAPL) stock gained 0.3% Monday, reaching $235.73. Loop Capital’s decision to raise its price target to $300 sparked fresh interest in the tech giant’s shares. The stock’s movement comes amid growing analyst confidence in Apple’s market position and future growth potential, with multiple firms raising their predictions for future gains.

Also Read: Bitcoin: This 2009 BTC Miner Made Over $80 Million

Analysts See Bright Future for Apple Stock After Recent Upgrade

Analyst Support Strengthens

Loop Capital’s ambitious $300 price target represents the highest among major analysts. JPMorgan Chase and Morgan Stanley maintained their “overweight” ratings with targets of $265 and $273 respectively.

Needham & Company reinforced their positive outlook with a “buy” rating and $260 target. The stock received additional support from Piper Sandler, who maintained a “neutral” stance with a $225 price objective.

Market Performance Details

Trading volume reached 8,058,778 shares during Monday’s session, marking a significant decrease from the average daily volume of 59,881,887 shares. The stock touched an intraday high of $236.09, building momentum from its previous close of $235.00. This performance reflects broader market confidence in Apple’s strategic position and growth trajectory.

Also Read: US Stocks: Top 3 Reasons To Buy Uber (UBER) Stock Now

Insider Trading Activity

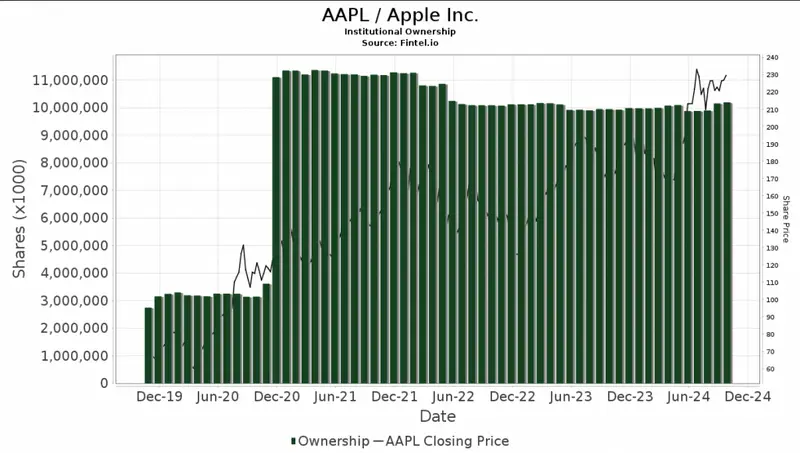

Some recent insider transactions have drawn market attention and for a good reason. CFO Luca Maestri sold 59,305 shares at a value of $226.52 each, with a total sum of $13.4 million. Another notable move came from insider Chris Kondo, who sold 5,178 shares at the value of $216.50. Institutional investors have maintained their strong presence, now controlling around 60% of the company’s stock. This demonstrates continued confidence in Apple’s long-term prospects.

Financial Performance Indicators

Apple’s latest quarterly results exceeded market expectations. The company reported earnings of $1.40 per share, surpassing analyst estimates by $0.06. Revenue reached $85.78 billion, outperforming projected figures of $84.43 billion. The company maintained a strong return on equity of 147.15% and a healthy net margin of 26.44%.

Also Read: Cryptocurrency: Meme Coin Hunters on the Rise, Turns $296 to $620,000

Among the 37 analysts covering the stock as we speak, the consensus remains at “Moderate Buy.” The average price target of $239.27 shows a continued potential to go up. Only one analyst maintained a sell rating against twenty-two buy recommendations. Which way would you go?