Bitcoin is once again gaining mainstream attention and the spotlight. The token is now climbing high on the radar, breaking new price ceilings and, at the same time, eyeing new price targets in a recent surge. This development has led the markets to bask in a bullish sentiment, watching Bitcoin rise to stabilize at $117K at press time. As Bitcoin ascends to new price highs, will it continue to soar high or tumble down again to neutralize the current surge? Let’s find out?

Also Read: Strategy (MSTR) Stock Surges as Bitcoin Booms, Buys Resume

Bitcoin Is Eyeing New Price Horizons

In a new historic milestone, Bitcoin (BTC) has now broken predicted pathways to hit a major new ATH of $122K. The token is currently down 2%, stabilizing around $117K at press time. However, the current price surge has led investors to speculate on new price momentum and ceilings that BTC can now break in the near future.

Per Ali Martinez, Bitcoin is already searching for a new price ceiling to break and can now target three new price spots that could change the market trajectory for the better. In his recent X post, Martinez was quick to share these three price ceilings, adding how BTC can now target the next key levels of $131,000, $144,000, and $158,000.

“Bitcoin $BTC has hit the first target at $121,000 after breaking out of a parallel channel. The next key levels are $131,000, $144,000, and $158,000.”

Bitcoin $BTC has hit the first target at $121,000 after breaking out of a parallel channel. The next key levels are $131,000, $144,000, and $158,000. pic.twitter.com/GsOFa0MyrJ

— Ali (@ali_charts) July 14, 2025

The Current BTC Path: What Lies Ahead for the Token?

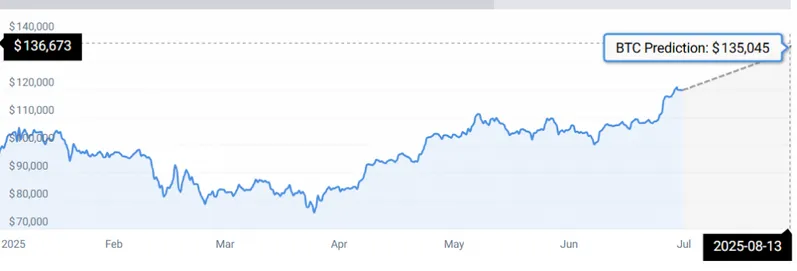

While Martinez’s BTC analysis is ambitious and certainly achievable, CoinCodex, on the other hand, shares a similar stance on BTC’s future price path. Per CC, Bitcoin may first hit $135K by mid-August 2025.

“According to our current Bitcoin price prediction, the price of Bitcoin is predicted to rise by 14.41% and reach $135,723 by August 14, 2025. Per our technical indicators, the current sentiment is bullish, while the Fear & Greed Index is showing 74 (greed). BTC recorded 19/30 (63%) green days with 4.23% price volatility over the last 30 days.”

Also Read: Bitcoin Tops Amazon to Become 5th Largest Asset