Ackman’s tariff pause demands have rocked financial markets this week as the hedge fund billionaire warned of some pretty dire economic consequences. The longtime Trump supporter actually called for an urgent 90-day halt to planned US tariffs 2025 implementation amid the deepening crypto market crash concerns and also growing business anxiety that’s spreading throughout the market right now.

The country is 100% behind the president on fixing a global system of tariffs that has disadvantaged the country. But, business is a confidence game and confidence depends on trust.

— Bill Ackman (@BillAckman) April 6, 2025

President @realDonaldTrump has elevated the tariff issue to the most important geopolitical…

Also Read: Ripple: XRP Eyes $7 Despite Market Uncertainty, Here’s How

Crypto Market Crash Deepens As Ackman Halts 2025 US Tariffs

Cryptocurrencies have tumbled quite sharply following the Ackman tariff pause announcement. Bitcoin fell to $77,300 on Monday, down about 7.6% and effectively erasing nearly $70 billion in market value. Ethereum also dropped an even more dramatic 14% to $1,555 in just a single day as investors frantically reacted to the latest Bill Ackman news.

Ackman’s Warning

Bill Ackman stated:

“By placing massive and disproportionate tariffs on our friends and our enemies alike… we are in the process of destroying confidence in our country as a trading partner.”

The hedge fund manager also emphasized:

“Business is a confidence game. The president is losing the confidence of business leaders around the globe.”

Without a pause, he warned the US could potentially face an “economic nuclear winter” crushing business confidence and possibly triggering mass layoffs across multiple sectors.

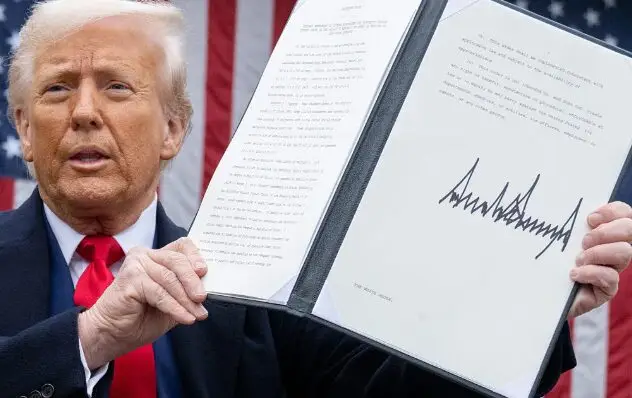

Trump’s Position

President Trump defended his approach from the White House:

“Our country and its taxpayers have been ripped off for more than 50 years. But it’s not going to happen anymore.”

The administration’s formula for calculating tariffs has been criticized by many economists as overly simplistic and potentially harmful. Trump’s crypto stance has also come under intense scrutiny as digital assets face increased volatility under the new trade policies at the time of writing.

Also Read: BTC: Why Is Bitcoin Crashing Today Falling to $76,000?

Market Impact

Tracy Jin, COO of MEXC Exchange, was clear about the fact that:

“The market is easily manipulated in its current state. This carries the threat of new disappointments… and this will call into question the status of Bitcoin as a safe haven asset, which may lead to an even sharper outflow of funds from the ETF.”

Jin actually predicted Bitcoin could drop to the “$52,000–$56,000 range” by summer. Even more, Ethereum could perform even worse due to additional structural challenges beyond the tariffs.

The crypto market crash has definitely intensified as Ackman’s urgent plea highlighted how the US tariffs 2025 implementation could seriously derail market confidence in the coming weeks. His call for reconsideration of the administration’s approach has really resonated with nervous investors across various market segments.

Business Confidence

Ackman’s most pointed criticism came in his statement:

“This is not what we voted for.”

Many business leaders who initially supported Trump now express genuine concern about the administration’s rather aggressive trade approach. The Bill Ackman news has created significant debate about the wisdom of implementing such broad tariffs during already uncertain economic conditions.

Also Read: Apple (AAPL): Why Experts Aren’t Panicked About Trump Tariffs

Looking Forward

The Ackman tariff pause request puts immediate pressure on the administration to reconsider its approach before the April 9 implementation date, which is rapidly approaching. Markets remain highly sensitive to developments right now, with the crypto market crash serving as a kind of leading indicator of broader investor anxiety.

US tariffs projections for 2025 suggest potentially significant economic disruption if implemented exactly as planned without modification. The Trump crypto stance will be closely watched in the coming days for any indications of whether the administration might actually soften its position in response to the latest Bill Ackman news and the broader market concerns that continue to mount.