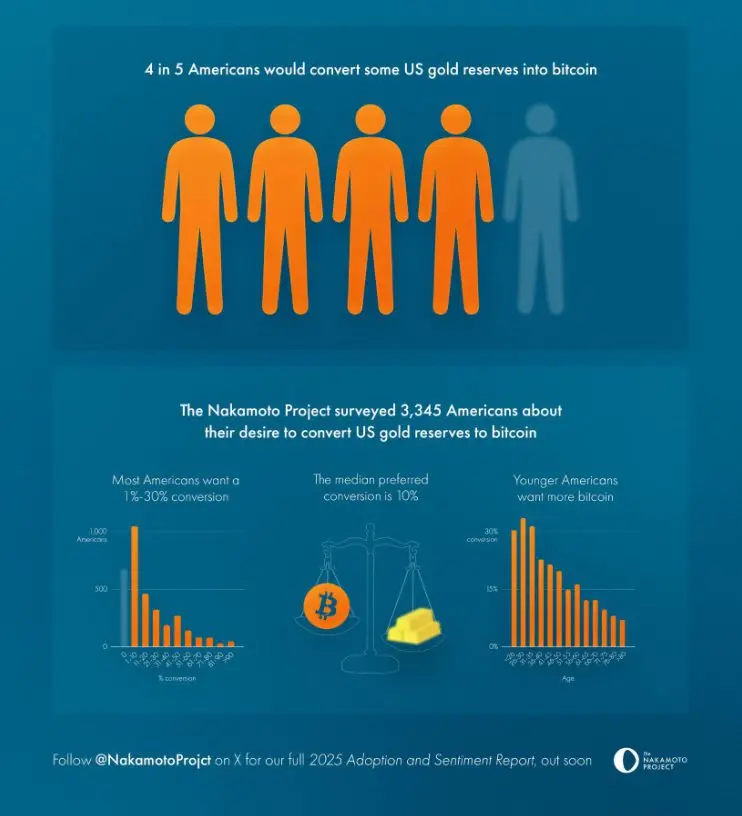

Bitcoin in National Reserves has become quite a fascinating topic of discussion right now, especially as trust in the United States dollar continues to face certain challenges. According to a recent and rather surprising survey, about 80% of Americans would actually prefer to see some portion of the national gold reserves converted into bitcoin, which really does signal a remarkable shift in public sentiment toward cryptocurrency.

4 in 5 Americans want some US gold reserves converted to bitcoin. pic.twitter.com/ibxXfe04g5

— The Nakamoto Project (@NakamotoProjct) May 19, 2025

Also Read: Goldman Sachs: MAG7 Hits 7-Year Low Amid AI, Trade & Antitrust Fears

Why Bitcoin Tops Gold as America’s New Currency Hedge of Choice

Many Americans are currently viewing Bitcoin in National Reserves as a potential hedge against inflation and also currency devaluation. This growing preference for cryptocurrency over traditional assets like gold seems to reflect increasing concerns about the long-term stability of the United States dollar at the present time.

Survey Reveals Strong Support Across Demographics

The Nakamoto Project, at the time of this writing, has surveyed approximately 3,345 Americans about their thoughts on Bitcoin in National Reserves, and they found consistent support across various demographic groups.

Troy Cross, associated with the project, stated:

“We were also surprised too. But the results are the results. Many other surveys have since vindicated what we found: in politics and in many other ways, American bitcoiners look much like America itself.”

Also Read: $1,000 in Shiba Inu & XRP: Which Will Give Better Returns in 2030?

Americans Favor Diversification Strategy

The survey also indicates that many Americans actually support currency substitution strategies that include cryptocurrency alongside traditional assets such as gold.

Dennis Porter, a digital asset commentator, noted:

“My final takeaway: Americans just don’t care about gold that much and most people are inclined towards diversification when given the choice.”

I didn’t believe it at first either but I dm’ed with @thetrocro and I came to the conclusion that it seems plausible.

— Dennis Porter (@Dennis_Porter_) May 20, 2025

My final takeaway: Americans just don’t care about gold that much and most people are inclined towards diversification when given the choice.

Bitcoin Halving Strengthens Reserve Case

Recent Bitcoin halving countdown events have really highlighted cryptocurrency’s potential as an inflation-resistant reserve asset. With Bitcoin’s diminishing supply rate and such, more and more Americans are beginning to see it as a valuable addition to National Reserves alongside the United States dollar.

Many of you are skeptical of our finding, released this morning that 4 in 5 Americans would convert some US gold reserves into bitcoin.

— Troy Cross (@thetrocro) May 19, 2025

"Yeah right! You must have done your survey at a bitcoin conference!"

We were also surprised too. But the results are the results.

The… pic.twitter.com/JzaBGwdfBq

Also Read: DigiAsia Unveils $100M Bitcoin Plan, FAAS Stock Surges 91% on Bold Bet

The concept of Bitcoin in National Reserves represents, in many ways, a fundamental shift in how Americans tend to view financial security. As cryptocurrency continues to gain mainstream acceptance right now, public pressure for diversification of National Reserves may well continue to grow in the coming months and years.