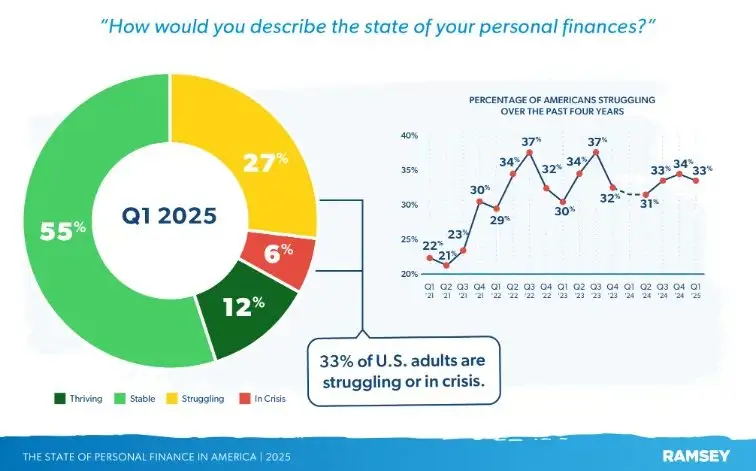

Americans living paycheck to paycheck now represent 53% of the nation’s workforce in 2025, according to Ramsey Solutions’ latest State of Personal Finance study. This financial insecurity 2025 trend affects families across all income brackets, with paycheck to paycheck statistics remaining stubbornly high throughout the past year. The widespread personal finance challenges extend well beyond simple budgeting, creating a crisis that impacts workplace productivity and mental health.

Also Read: Markets Flash Green After Hayes Declares: ‘Buy Everything’

Americans Living Paycheck to Paycheck Face Financial Insecurity and Budgeting Challenges

High Earners Also Struggle Financially

The data reveals that Americans living paycheck to paycheck aren’t just lower-income households. While 72% of those earning under $50,000 face this reality, 36% of Americans making over $100,000 annually also live paycheck to paycheck.

Families with children experience even greater pressure, with 62% reporting paycheck to paycheck statistics in their households. Women face higher financial distress than men (41% vs. 25%), while Generation X leads all age groups at 40% struggling financially.

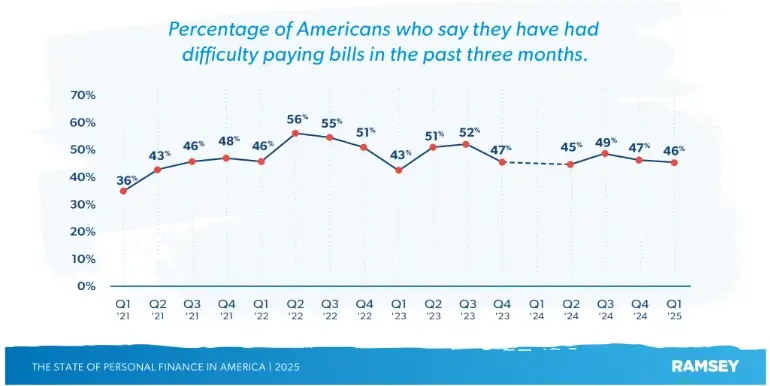

Housing costs continue straining budgets, with 52% of renters reporting difficulty paying rent and 32% of all Americans paying bills late in recent months.

Retirement Crisis Affects All Generations

Two-thirds of Americans plan working past age 65, with one-third stating they must continue working out of financial necessity. This forced work pattern affects 33% of Gen Z, 31% of millennials, and 36% of Gen X workers, highlighting how financial insecurity 2025 spans generations.

Millennials report particularly troubling paycheck to paycheck statistics, with 53% saying their debt exceeds retirement savings. Current retirees aren’t faring much better, as 46% of baby boomers live on less than $100,000 in retirement savings.

Mental Health Impact of Financial Stress

Financial anxiety leads to a wide variety of personal finance problems that go farther than checking accounts. Every day, six in ten adults worry about finances and 40% find that money keeps them from sleeping. Many employees say they are distracted at work due to financial worries which leads to a drop in workplace productivity for blue-collar and white-collar workers alike.

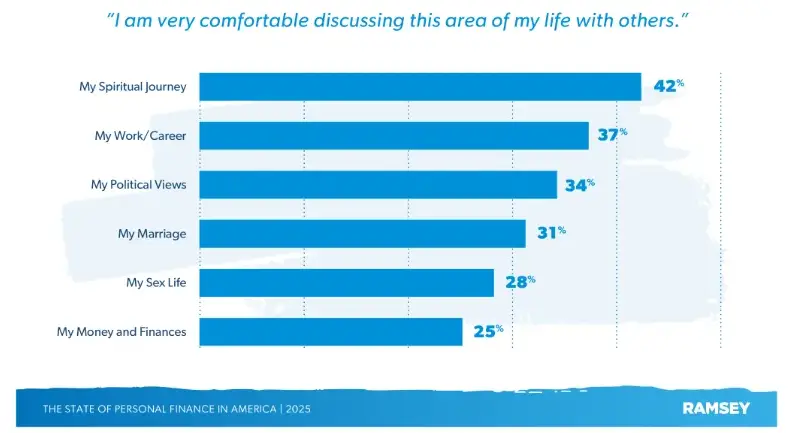

From the study, people in America who live paycheck to paycheck consider it harder to discuss finances than any other sensitive topic. Because of this financial taboo, many are afraid to ask for help during tough times.

Also Read: West’s Decline? Economic Giants to Surpass 40% GDP as SWIFT Dies – Russian Official

Economic Outlook and Policy Concerns

Many react differently to what the new Trump economy offers. Though almost half think the economy will improve under new leaders, most Americans are concerned that trade trouble might not be good for their finances.

People from all demographics are sensitive about their finances in 2025, but women are more worried than men (64% compared to 56% for men). Most people in the United States agree that government cuts should happen and representatives from all demographics support this. Still, only 46% of people say they trust the Department of Government Efficiency, hinting that there is still doubt over the methods being used to address the large number of people living paycheck to paycheck.

The truth about finances shows that Americans struggling with little money in between paychecks is becoming widespread and both people and the system must do their part to help solve the financial challenges of millions of US families.