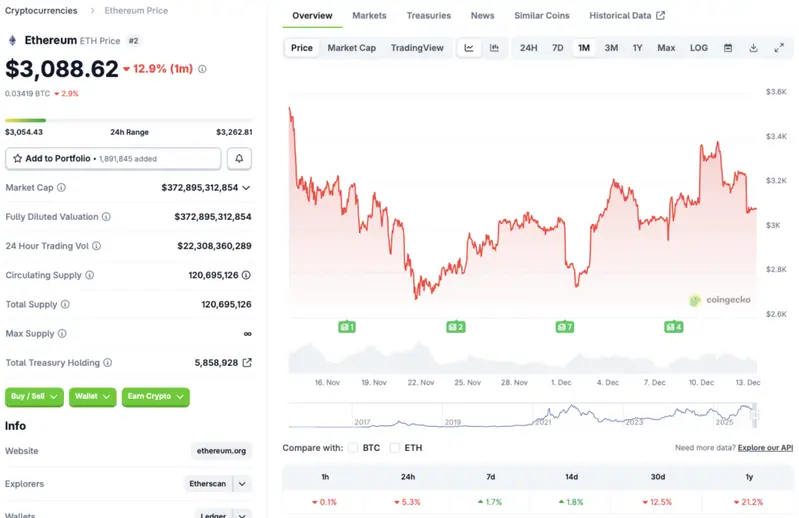

The cryptocurrency market seems to see no end to the downtrend that started in October. Bitcoin (BTC) is struggling to break past the $90,000 price level, and other cryptocurrencies are following BTC’s consolidation trajectory. Ethereum (ETH) now faces a risk of falling below the $3000 price point. The second-largest crypto by market cap has dipped 5.3% in the last 24 hours, 12.5% over the last month, and 21.2% since December 2024, according to CoinGecko’s ETH data. Despite the downtrend, ETH’s price has risen 1.7% over the last week and 1.8% in the 14-day charts. Let’s discuss why ETH and the larger crypto market are struggling, and if things will improve in 2026.

Why Is Ethereum Falling?

Ethereum’s (ETH) current predicament comes amid a market-wide bearish tone. Bitcoin (BTC), the market leader, is showing signs of consolidation around the $90,000 mark. The current lackluster market is surprising, considering the fact that the Federal Reserve rolled out a 25 basis point cut earlier this week.

Ethereum (ETH) may be facing the consequences of investors taking a risk-averse approach. Silver hit an all-time high on Friday, signaling increased inflows. Market participants are likely worried about slow economic growth amid macroeconomic uncertainties. Investors are also worried that the Federal Reserve will not announce another interest rate cut over the coming months. The bearish signals could pull Ethereum (ETH) below the $3000 mark.

Despite its current lackluster trajectory, Ethereum (ETH) may pick up the pace over the coming months. Tom Lee’s Bitmine recently bought 14,959 ETH worth around $46 million. The move could be a signal of a bullish reversal coming ahead.

Also Read: If Atkins’ Prophecy Comes True, Ethereum Wins Big in Just Two Years

Moreover, several analysts have predicted that Bitcoin (BTC) will hit a new all-time high in 2026. Grayscale and Bernstein anticipate the original cryptocurrency to follow a 5-year cycle, instead of a 4-year cycle. BTC hitting a new all-time high could trigger a rally for Ethereum (ETH) as well.