Leading stocks in the US markets have generated profits of more than 1,000% in the last five years. The significant returns came after the economy came out of the COVID-19-induced downturn. The recovery was fast and quick, and traders who took an entry position during the dip and waited for five years now have made tenfold returns. In this article, we will highlight the top 3 US stocks that delivered 1,000% profits since 2020.

Also Read: SpaceX Launch Today on Falcon 9 Rocket: Can I Buy SpaceX Stock?

US Stocks That Are Up More Than 1,000% in 5 Years

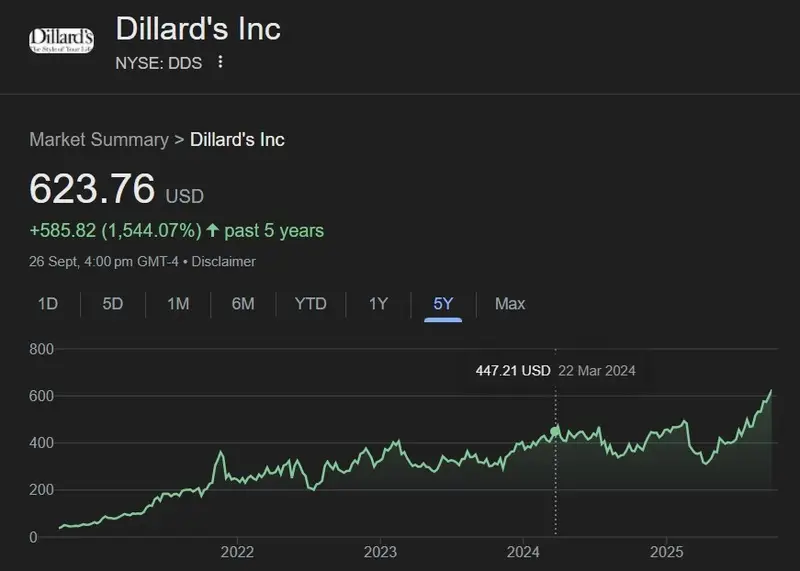

- Dillard’s Inc

Dillard’s Inc. (NYSE: DDS) has soared a staggering 1,544% in the last five years. Its price was trading at $37 in 2020 as the Coronavirus wreaked havoc across the globe. Once the market recovered from the deep slumber, Dillard’s rose like a phoenix and is still attracting bullish sentiments. Dillard’s is among the top US stocks that have generated mind-blowing returns since 2020. DDS is currently hovering around the $623 level. Therefore, an investment of $1,000 turned into $16,440 in the last five years.

Also Read: BMO Raises S&P 500 Index Forecast to $7,000 by 2025 End

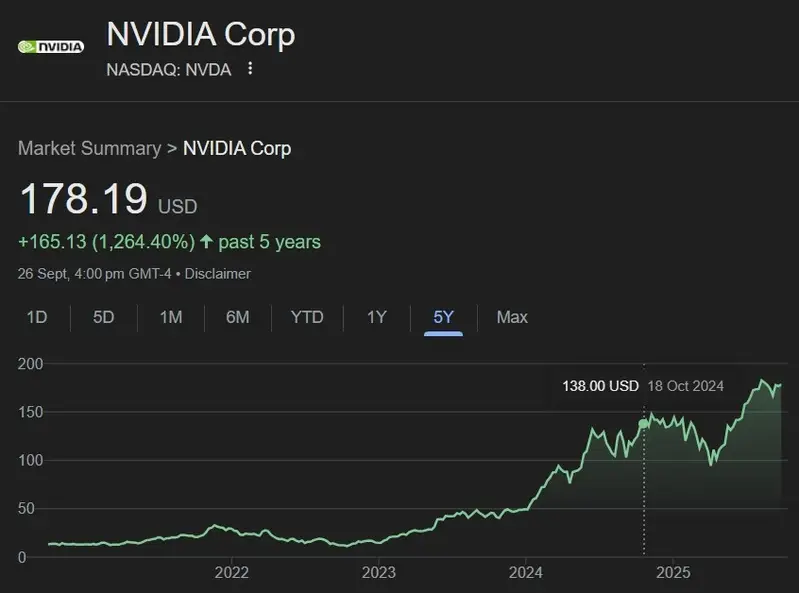

- Nvidia

Nvidia (NASDAQ: NVDA) became the darling of the US market as it outperformed all stocks in five years. NVDA has surged 1,264% since 2020 and is still in a commanding position in the markets. It is being accumulated by retail investors and institutional funds with greater confidence. NVDA was trading at $13 in 2020 (after split price) and is now at $178. An investment of $1,000 has turned into $13,640 in five years.

- GameStop

GameStop (NYSE: GME) is among the top-performing US stocks since 2020. GME has generated returns of 1,024% as it remains in the limelight since the infamous GameStop ‘short squeeze’ saga that emerged out of Reddit forums. Traders who held on to the stock and invested $1,000 have seen their money grow into $11,240 now. While several outlets called GameStop “dumb money,” investors brushed it off and are now sitting on heaps of profits.