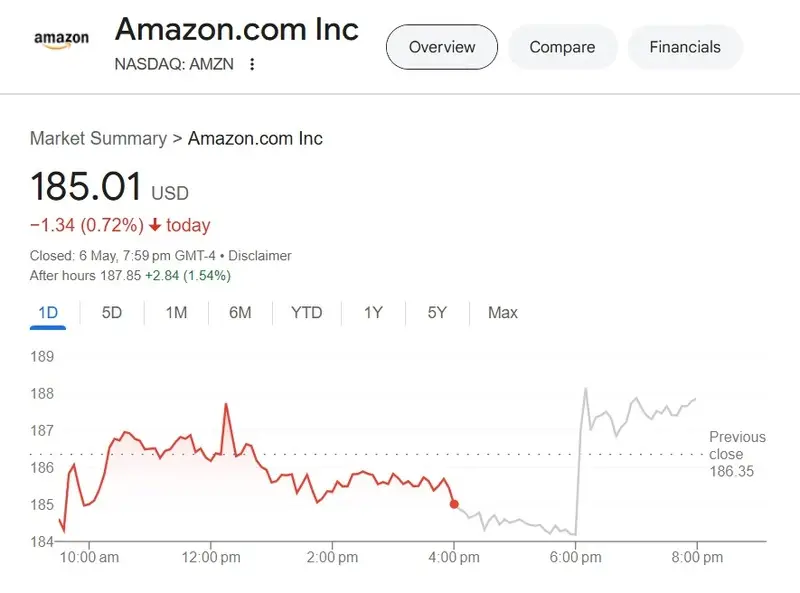

Amazon stock (AMZN) opened at $185 on Wednesday’s trading bell and is struggling to climb above $200 since March. Despite repeated attempts, the leading e-commerce giant is facing difficulties in moving ahead in the charts. The leading stock is already down nearly 16% year-to-date as it fell from a high of $242 early this year. It is reeling under the trade wars and tariffs, and the firm is directly affected by the polices.

Also Read: Japan’s $1.1 Trillion in U.S. Treasuries: A New Weapon in Economic Warfare

The 90-day pause on tariffs acted as a breather for Amazon stock as investors took entry positions for quick profits. A recent price prediction for AMZN is bullish with double-digit gains by the end of the year. Investors who take an entry position in the stock below the $200 price range could make profits in 2025. The projection forecasts that AMZN could sustainably scale up in price after the tariffs are lifted.

Also Read: De-dollarization in Action: China & Japan Back $240B Yuan-Based Bailout Fund

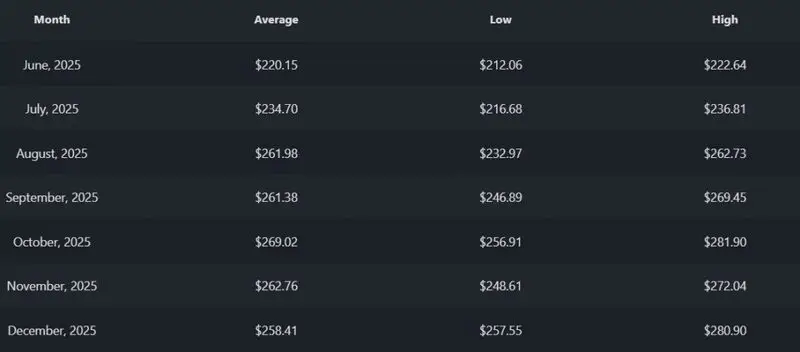

AMZN: Amazon Stock Forecasted to Reach $280

Leading price analysis firm StockScan recently predicted that Amazon stock could end 2025 at the $280 mark. That’s an uptick and return on investment (ROI) of approximately 50% from its current price of $185. Therefore, an investment of $1,000 could turn into $1,500 by December 2025 if the forecast turns out to be accurate.

Also Read: Chainlink: AI Predicts LINK’s Price For May 10

The forecast suggests that this might be a good time to accumulate Amazon stock as its price is below $200. The projection indicates that its price could gain steam at the end of Q2 this year. The $1.96 trillion company has its wings spread across all sectors from e-commerce to cloud, and the recent AI tech.

The paths to bring in revenues are aplenty, making Amazon stock a prime investment among the trading community. Apart from AMZN, find out how high or low tech giant Apple (AAPL) could trade in the charts this year.