Shiba Inu burn events are making quite a stir in the crypto world. Well, another massive 1 billion SHIB tokens are being removed from circulation. Despite these pretty significant burns happening one after another, many investors and Shiba Inu coin enthusiasts are wondering why these actions haven’t actually translated to any noticeable price movements for the popular meme coin.

Also Read: Pi Network (PI) Faces 50% Correction: Should You Buy The Dip?

Shiba Inu Burn & Price Impact: What Investors Need to Know

Another Billion SHIB Vanishes

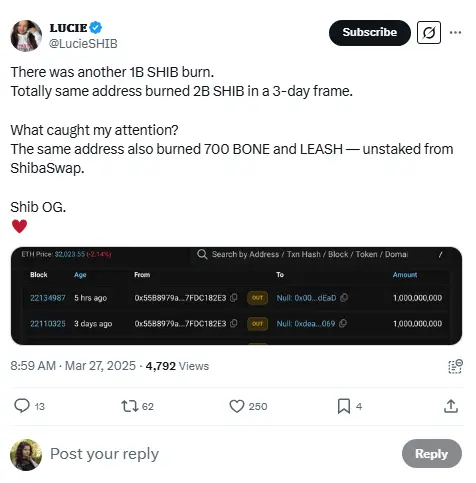

A massive Shiba Inu burn of 1 billion tokens was executed just recently. This marks the second such event within a three-day timeframe. The burn was performed by the same anonymous wallet that previously incinerated another billion SHIB. Therefore, it brings their total to an impressive 2 billion SHIB removed from circulation in less than a week.

Lucie, the marketing expert for the Shiba Inu team, noted on social media:

“There was another 1B SHIB burn. Totally same address burned 2B SHIB in a 3-day frame.”

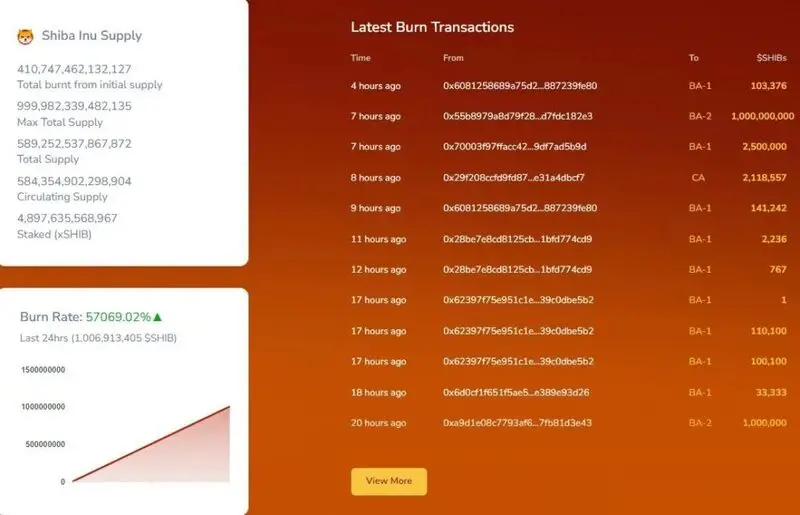

The burning process, which is becoming increasingly common in the crypto market trends, involves sending tokens to specialized “dead” wallets from which they can never be retrieved, basically removing them permanently from circulation. This particular burn actually contributed to an astonishing 57,069% increase in the SHIB burn rate over a 24-hour period.

Market Response Remains Muted

Despite the removal of tokens valued at approximately $14,410 at the time of writing, the Shiba Inu coin price has shown minimal reaction to these Shiba Inu burn events. The current circulating supply exceeds 589 trillion tokens, meaning even a billion-token burn represents only about 0.00034% of total supply, which is really quite small when you think about it.

Also Read: Cardano (ADA) Price Prediction For April 2025

Broader crypto market trends have also been applying downward pressure on many altcoins lately. Investor sentiment across the cryptocurrency sector often overrides tokenomics during periods of market uncertainty, such as what we’re seeing right now.

The CENT Connection

The identity behind these burns has been partially revealed. On March 24, the X account of the CENT meme coin claimed responsibility for the initial billion-token burn. They expressed intentions to burn even more SHIB in the future. That’s a promise that seems to have been fulfilled with this second burn event.

These actions by the CENT team have been welcomed enthusiastically by both the Shiba Inu team and also the broader SHIB community. Many Shib price prediction analysts suggest that continued burns could eventually impact the token’s value if sustained over longer periods, though immediate effects remain limited.

Sgina Inu Burn: Long-Term Implications for Holders

For existing Shiba Inu coin holders, these Shiba Inu burn events represent part of a broader deflationary strategy that’s being implemented right now. The theory centers on creating scarcity over time, which should theoretically increase the value of remaining tokens, at least in principle.

The Shiba Inu ecosystem continues developing additional utility features like SHIB Pay alongside these burn events. For investors focused on Shiba Inu news, these burns signal ongoing development activity within the ecosystem. This applies even if immediate price movements remain elusive.

Also Read: Bitcoin Reserves a ‘Time Bomb’

While the immediate price impact of each Shiba Inu burn may be minimal, these deflationary actions could influence future value. This applies in the context of crypto market trends evolving and more and more tokens being removed from circulation.