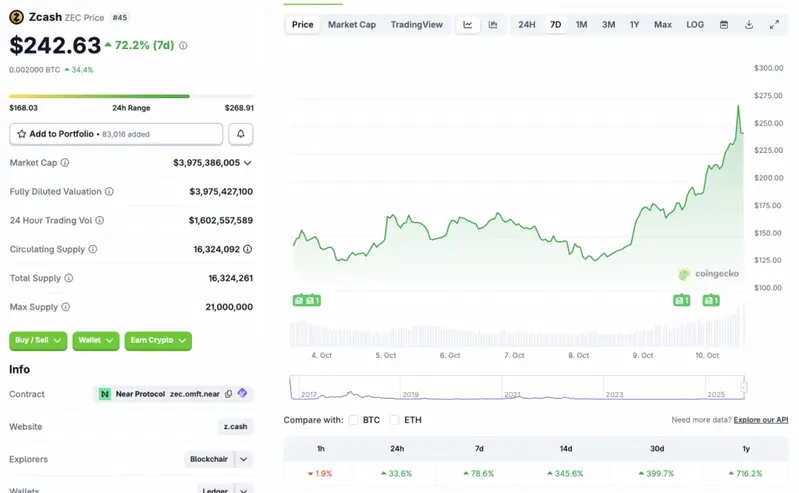

While the larger crypto market is facing a correction, Zcash (ZEC) is absolutely destroying the competition. According to CoinGecko, ZEC is currently the best-performing cryptocurrency in the daily, weekly, and monthly charts. The 45th largest crypto by market cap has rallied by 33.6% in the last 24 hours, 78.6% in the last week, 345.6% in the 14-day charts, and nearly 400% over the previous month. Zcash (ZEC) has also registered a 716.2% rally since October 2024. Let’s discuss what’s pushing the asset’s price.

What’s Behind Zcash’s Massive Rally?

Zcash (ZEC) seems to be making a comeback after years of struggle. Experts say the rally is driven by growing institutional access and powerful social media endorsements. According to Sean Dawson, head of research at Dervie,

According to Sean Dawson, the price surge is largely fueled by Grayscale giving access to eligible investors through its funds. Dawson also highlights support from investor Naval Ravikant as another factor behind Zcash’s (ZEC) rally.

ZEC also gained attention from Mert Mumtaz, CEO of Helius Labs. Mumtaz highlighted Zcash’s privacy-focused outlook as one reason for his support. Mumtaz further stated that the project will roll out new technology improvements that will increase performance by 1000X.

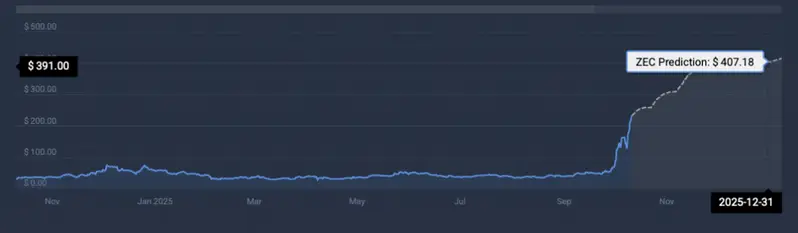

According to CoinCodex analysts, Zcash (ZEC) will continue its rally over the coming months. The platform anticipates the asset to hit $407.18 on Dec. 31 of this year. Hitting $407.18 from current price levels will translate to a rally of about 67.8%.

Also Read: Bitcoin vs. Gold: Which Will Give Better Returns By 2030?

While the immediate future looks promising, unforeseen challenges could present hurdles to Zcash’s price. The larger market is still quite fragile. Bitcoin (BTC) is struggling to gain momentum. ZEC could succumb to the larger market trend over the coming days and face a price correction. Moreover, despite the latest upswing, the privacy-focused Zcash (ZEC) coin is down by more than 92% from its all-time high $3,191.93, which it attained in October 2016, nine years ago.