XRP everything just changed as technical indicators and institutional movements signal a potential rally, with the XRP price prediction now pointing to a $3.60 target. The XRP price prediction for end of 2025 looks increasingly bullish as capitulation metrics reach historic lows and corporate treasury allocations exceed $2 billion, with signs of XRP price going up becoming more evident across multiple timeframes and showing that XRP everything just changed in recent weeks.

Right now, the XRP price prediction is being shaped by one key metric that’s flashing a historically significant signal, and it’s worth paying attention to. Crypto analyst StephIsCrypto has identified that the short-term holder NUPL ratio has dropped to approximately -0.2, marking what’s potentially the lowest reading ever recorded for XRP under this metric at the time of writing.

Also Read: Top Analysts Share Their XRP Price Prediction For End of 2025

When this ratio enters the capitulation zone, short-term holders are selling at losses, and these moments have been observed to align with major market bottoms historically. Back in October 2024, XRP was hovering around $0.50 when capitulation hit, and those who bought during that phase saw the asset climb to nearly $4 in the following months. The same pattern played out again in March 2025 and also in June 2025, with XRP price going up significantly after each capitulation event and showing that XRP everything just changed multiple times throughout the cycle.

XRP Price Prediction and Rally Outlook Amid Everything Just Changed

Critical Bottom Signal Emerges

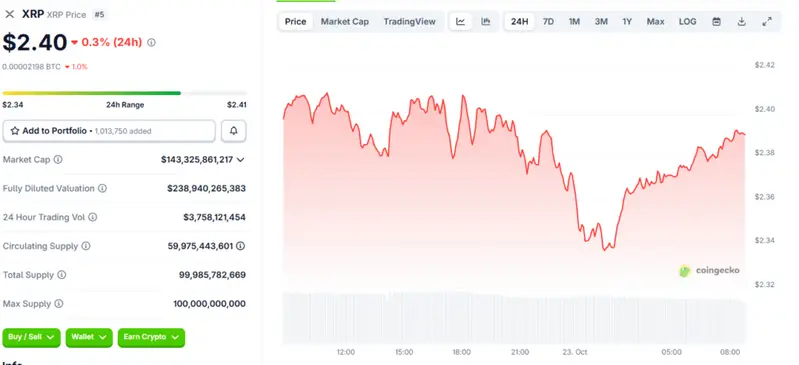

The XRP price prediction rally thesis is getting strong technical support right now, and multiple indicators are pointing in the same direction. XRP is holding around $2.40, which represents about 10% gains from Friday’s low, and the weekly chart shows price just bounced off the 0.618 Fibonacci level—a zone that buyers typically defend with significant force and conviction.

If this momentum continues building strength, the next upside target sits near the cycle high around $3.60, which would represent substantial gains from current levels. The weekly chart still shows higher highs and higher lows even with all the volatility, and price has tested the flash crash zone twice now, bouncing strongly both times.

Institutional Treasury Additions Accelerate

With XRP everything just changed on the institutional front as well, both technical and fundamental factors are starting to align in favor of bulls. More than 11 companies are preparing to add XRP to their treasuries right now, and the total allocation is being reported at over $2 billion. SBI, which happens to be Japan’s biggest banking group, just confirmed its Evernorth XRP investment, and following that, GUMI announced its position worth around $17 million. The institutional adoption narrative has been gaining momentum, and XRP price going up seems more likely as these treasury additions continue accelerating.

End of 2025 Outlook Takes Shape

These new developments have dramatically changed the XRP price prediction end of 2025 scenario, and the signs of congruency are drawing the attention of analysts. In his analysis, StephIsCrypto notes that the present state of events has historically signified the last stage of a downward pressure in the past cycles, and thus encourages the investor to trust empirical evidence instead of using emotional reactions to the short-term fluctuations.

Also Read: Ripple Backs $1B SPAC as Analyst Sets XRP Price Target at $10K

This trend that has developed is relatively straightforward by now – capitulation by short-term sellers has been historically commensurate with ideal purchasing ranges as opposed to the times when the stock starts to fall. Short term fear and selling pressure characterized all the past cases, with significant upside following within a relatively short period of time. At this point, all that changed as institutional money is pouring in at a rate never seen before and technical signs of increasing XRP price to that 3.60 price target, maybe even higher, as 2025 enters its last months.

The fact that the current market positioning reflects what happened in 2024, just before a significant vertical price movement occurred, also supports the XRP price prediction rally. The cryptocurrency actually fell below 2 dollars in the last market correction but recovered once again, mirroring other past bottom formations that significant upward trends followed.

XRP Price Prediction: Remarkable Set-up to Move Up

Combined with the manifestation of the most egregious NUPL readings, Fibonacci support levels that have held, and an increasing rate of institutional adoption at the time of writing has formed what analysts believe to be a remarkable set-up to move up, indicating that XRP everything just changed and the XRP price prediction end of 2025 may see the target set well above current levels should historical trends repeat themselves once more.