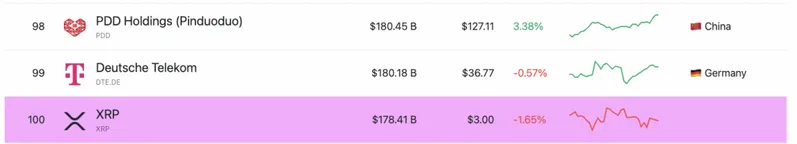

According to companiesmarketcap.com, XRP is now the 100th largest asset in the world, with a market cap of $178.41 billion. XRP has overtaken BlackRock, the world’s largest asset manager, which has a market cap of $177.80 billion. The move is a significant milestone for the popular cryptocurrency.

Will XRP Climb To a New Peak After Overtaking BlackRock’s Market Cap?

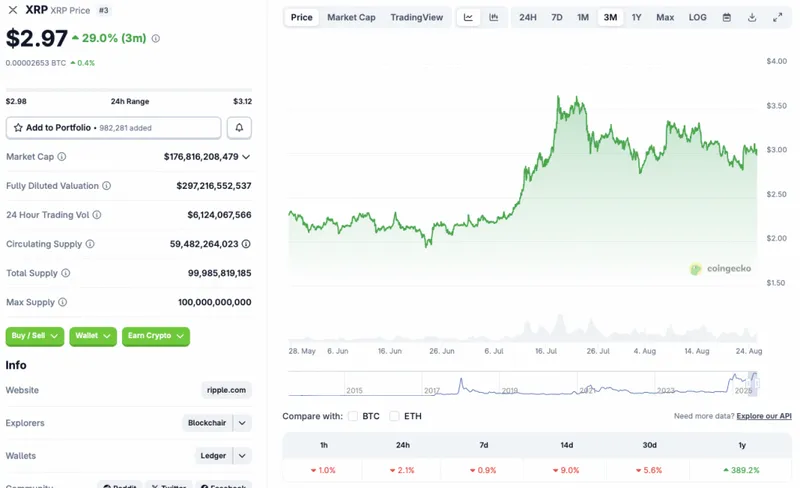

While XRP’s market cap has hit a new milestone, the asset’s price has faced a sharp correction over the last few days. XRP climbed to a new all-time high of $3.65 on July 18. Since its peak, the asset’s price has fallen by 18.5%. XRP is also trading in the red zone in nearly all time frames. According to CoinGeck’s XRP data, the popular cryptocurrency is down 2.1% in the daily charts, 0.9% in the weekly charts, 9% in the 14-day charts, and 5.6% over the previous month. Despite the price dip, XRP has rallied by 389.2% since August 2024.

XRP has had quite a bullish year in 2025. The asset breached the $3 mark for the first time in more than seven years earlier this year. XRP’s rise is likely due to the SEC vs. Ripple lawsuit coming to an end. The lawsuit was a substantial barrier to the asset’s price.

Also Read: XRP Buy Alert: 2 Powerful Signals of Ripple’s Soaring Rally Ahead

There is a high chance that XRP will continue its ascent after its market cap beat BlackRock’s. There are several spot XRP ETFs awaiting approval at the SEC. While BlackRock has opened its doors to Bitcoin and Ethereum ETFs, the firm has yet to apply for an XRP ETF. BlackRock said that it does not intend to apply for a spot XRP ETF just yet. However, an ETF approval will likely lead to a surge in institutional inflows for the asset. Such a scenario could propel XRP’s price to a new all-time high.