XRP has hit a turning point. The price fell below $0.50 to $0.4930 this weekend. Market signals show a big move coming soon. Trading volumes show strong interest between $0.50 and $1. Daily trades have reached $2.1 billion, with many orders clustered near $0.50. Recent volume patterns suggest mounting pressure at key price levels.

Also Read: Shiba Inu: How To Be A Millionaire When SHIB Hits $0.000075?

Navigating XRP’s Price Movements: Market Analysis and Predictions

Critical Support and Resistance Levels

Key support sits at $0.4850, with backup at $0.4720. Strong resistance exists at $0.5300 and $0.6100, with the toughest barrier at $0.7500. Heavy trading at these prices shows traders defending these levels. Market data shows strong buying at $0.48 and selling pressure above $0.53. Order book analysis reveals significant liquidity pools forming at each major level.

RSI shows the price is oversold. MACD hints at a trend change. These signals, plus a 99% rise in XRPL transactions this quarter, suggest buyers are collecting XRP. Derivatives markets show $580 million in open trades, mostly betting on price rises. Short-term momentum indicators point to a potential trend reversal.

Immediate Catalysts and Market Forces

The SEC lawsuit still drives price changes. Big investors sell above $0.70, while smaller traders buy below $0.50. Options trading shows defensive positions at $0.50, suggesting traders want protection at this level. Market sentiment indicators reveal growing institutional interest despite regulatory uncertainty.

Also Read: Peanut the Squirrel Sparks Solana Meme Coin Frenzy: $200 Target

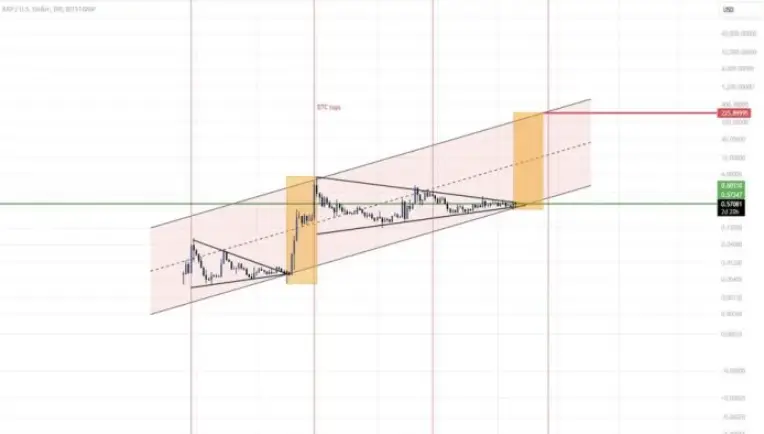

Analyst Amonyx spots a symmetrical triangle pattern that signals a big move soon. Similar patterns have led to 60-80% price shifts before. Fibonacci levels match key barriers, with $0.6234 as the crucial turning point. Volume analysis confirms increased activity at these technical levels.

Market Structure Changes and Price Impact

WallStreetBulls suggests switching from XRP/BTC and XRP/USDT pairs to XRP/RLUSD. This change could reduce price suppression and spark quick gains. Market makers show less resistance to price rises above $0.60. Exchange order books reflect shifting trader sentiment at key levels.

$0.5055 marks a key price point. Options markets suggest a 65% chance of hitting $1 before dropping to $0.50. Growing institutional interest and Valhil Capital’s $3,541 fair value estimate support higher prices. Large XRP holders have increased by 3.2% this week. Recent derivatives data shows bullish positioning across major exchanges.

Also Read: De-Dollarization: 20 Countries Ready to Ditch the US Dollar

ADX and Stochastic RSI show growing upward momentum above $0.52. Yet prices must break past $0.5300 to avoid falling to $0.50. Big traders have placed large orders at $0.55, suggesting they expect upward movement. The current market structure and technical setup indicate an increasing probability of upward price resolution.