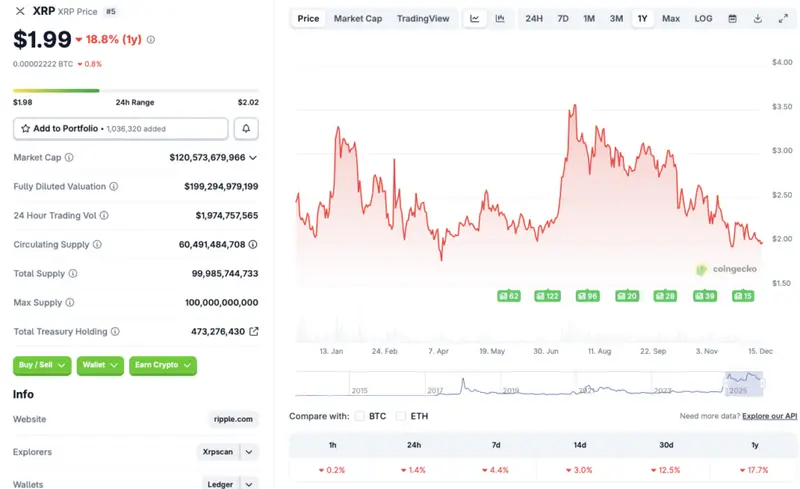

Ripple’s XRP token has once again fallen below the $2 mark. According to CoinGecko data, the popular cryptocurrency is down 1.4% in the last 24 hours, 4.4% in the last week, 3% int he 14-day charts, and 12.5% over the previous month. Despite the ongoing market turmoil, 2025 has been one of the most bullish years for XRP since 2020. The asset breached the $3 mark earlier this year, in January, for the first time in seven years. Let’s discuss why XRP may be nearing a price rebound soon.

XRP’s Price Fall Below $2 Could Be The Last Straw

While XRP’s price is struggling to gain momentum, the ETF products based on the asset have seen consistent inflows. XRP ETFs have seen inflows for 30 consecutive days. The funds have seen about $990 million in net inflows, with more than $1 billion in assets. Bitcoin (BTC) and Ethereum (ETH) ETFs, on the other hand, are seeing quite the opposite.

ETF inflows have been a key driver in the 2025 market cycle. BTC and ETH have hit new all-time highs, thanks to consistent ETF inflows. XRP may see a similar pattern over the coming weeks.

Moreover, many anticipate Bitcoin (BTC) to hit a new all-time high in 2026. Bernstein predicts BTC to hit the $150,000 mark next year and breach the $200,000 mark in 2027. Grayscale also anticipates BTC to hit a new high in 2026. Both financial institutions claim BTC has pivoted from its 4-year cycle, and it now follows a 5-year trajectory. BTC hitting a new peak will likely lead to a price surge for XRP as well.

Also Read: Ripple Expands to South Korea With $300 Million Venture Fund: XRP To Gain?

While Bernstein and Grayscale present bullish outlooks for the crypto market, Barclays is quite pessimistic. Barclays’ analysts say that the crypto market could face challenges in 2026. The firm cites low trading volume and weak demand for its claims. Such a scenario could lead to XRP’s price falling further.