The US stock market has woken up to a series of tumultuous war chaos, especially with the US intervening in the Iran-Israel conflict. The US ended up bombing three key nuclear sites of Iran, in an effort to paralyze the nation’s nuclear dreams. This development has triggered massive stock market chaos, with the majority of the Asian stock markets flashing deep red. Is another Black Monday in sight for investors as the looming war crisis intensifies rapidly? Let’s explore the possibilities.

Also Read: 10 US Stocks That Reached 52-Week Highs & Lows

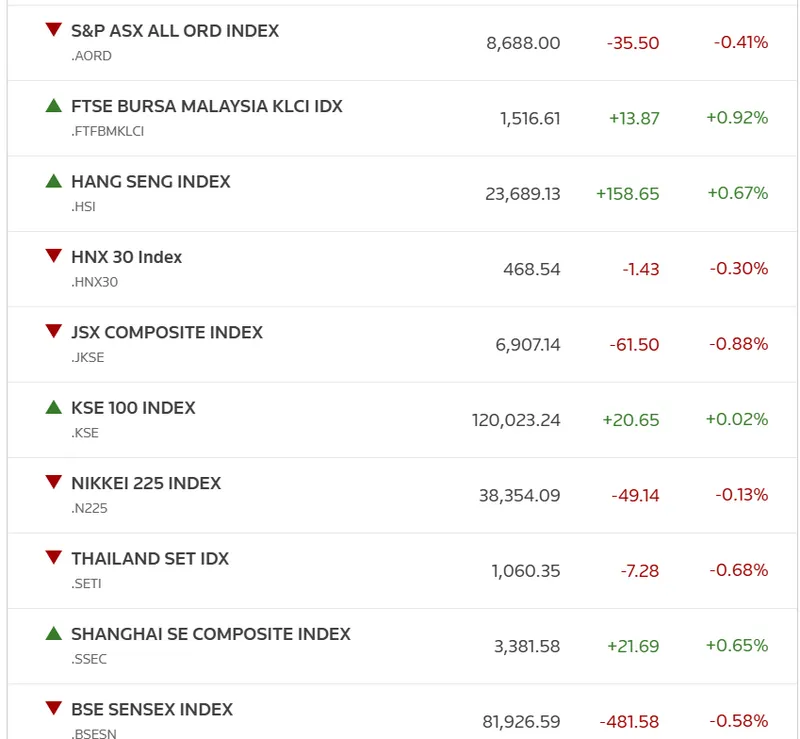

Asian Stock Markets Are Down, Flashing Bold Red

The majority of the Asian stock markets have reported staggering numbers, reporting a downturn due to the rising Israel-Iran conflict. The investors have now adopted a cautious stance, speculating on whether the war crisis could deepen or intensify in the coming weeks. With the US bombing Iran’s key nuclear facilities, the world is now anticipating a rigorous retaliation from Iran, as Iran’s supreme leader, Ali Khamenei, vows to retaliate with a stronger force.

JUST IN: 🇮🇷🇺🇸 Iran says the door to diplomacy with the US is no longer open. pic.twitter.com/i3qnqRF1Z9

— BRICS News (@BRICSinfo) June 22, 2025

That being said, Russia and North Korea have openly condemned the US attack on Iran, adding that the nation has the right to pursue nuclear expansion to protect itself.

JUST IN: 🇷🇺🇺🇸 Russia warns US President Trump opened 'Pandora's box' with its attack on Iran, and no one knows what consequences it will lead to. pic.twitter.com/jb5I0nWzEy

— BRICS News (@BRICSinfo) June 23, 2025

A mix of these elements has had a catalytic impact on the world markets that have been flashing red all across, signalling a chaotic momentum. The majority of the Asian Pacific indexes are down, with the S&P ASX All Ord index, HNX 30 Index, Nikkei, and Thailand set IDX showcasing plummeting metrics.

The majority of the European stocks are also down, as rising war narratives continue to degrade investor sentiment

What About The Cryptocurrency Market?

The cryptocurrency market is also expected to navigate volatile waters as the Iran-Israel conflict continues to escalate aggressively. Bitcoin is currently sitting at $101K after falling from its earlier high of $107K.

JUST IN: $875,000,000 liquidated from the crypto market in the past 24 hours.

— Watcher.Guru (@WatcherGuru) June 22, 2025

However, per a new cryptocurrency expert, the region could soon become a hub for all things crypto if narratives continue to favour a developing story.

President Trump is now vying for a regime change in Iran, a pro-Trump regime, per an expert, which could change the crypto trajectory in the Middle East for the better.

According to Stellar Rippler, a regime change in Iran by the US could boost crypto adoption in the region.

“How would a Regime change in Iran affect crypto? It would open the gates for crypto adoption in the Middle East. BTC might still be considered a hedge against inflation. Ripple’s deep roots in the Middle East quietly shape the region’s shift toward digital finance. One corridor, one central bank at a time. StellarOrg has steadily embedded itself across the Middle East. Powering cross-border payments and quietly enabling the region’s financial digitization behind the scenes.”

(6/🧵) How would a Regime change in Iran affect crypto?

— Stellar Rippler🚀 (@StellarNews007) June 22, 2025

It would open the gates for crypto adoption in Middle East.

BTC might still be considered as a hedge against inflation.@Ripple’s deep roots in the Middle East quietly shape the region’s shift toward digital finance, one… pic.twitter.com/PiRns1LXsI

Also Read: Billionaire’s Downbeat Outlook for US Stocks: S&P 500 Is Going Nowhere