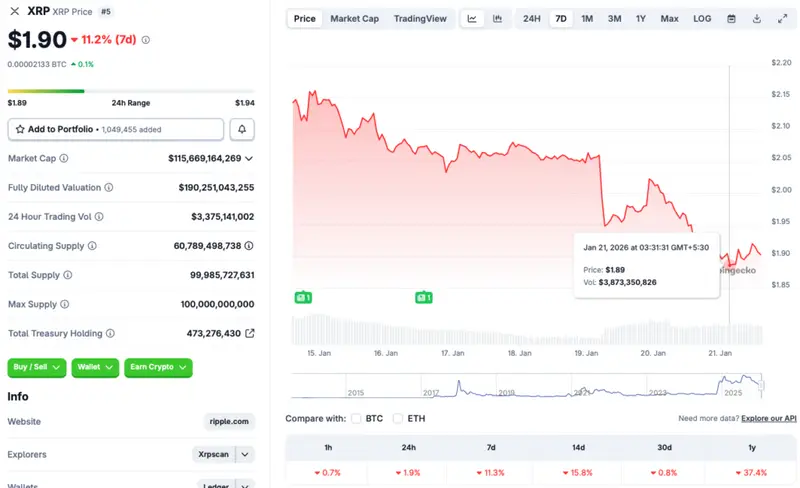

Ripple’s XRP token has faced yet another price correction, trading in the red zone across all time frames. XRP’s price has fallen below the $2 mark once again, a level that seems to offer substantial support. According to CoinGecko data, XRP’s price has faced a dip of 1.9% in the last 24 hours, 11.3% in the last week, 15.8% in the 14-day charts, and 0.8% over the previous month. However, there is a chance that XRP will rebound from its crash after the Federal Reserve’s $55 billion liquidity injection. Let’s discuss.

Can The Federal Reserve’s $55 Billion Liquidity Save XRP From Its Price Dip?

The Federal Reserve has announced that it will inject $55 billion in liquidity over the coming weeks. The first liquidity $8.3 billion package was injected on Jan. 20, 2026. The move could lead to a surge in the crypto market. Bitcoin (BTC) has historically rallied after a Federal Reserve intervention. XRP could follow BTC’s trajectory if the original crypto breaks out.

Moreover, earlier this month, CNBC called XRP the “hottest crypto deal of 2026.” Many experts anticipate the asset to rally over the coming months. XRP also saw the launch of several spot ETFs late last year. ETF inflows could pick up, driving the asset’s price further north.

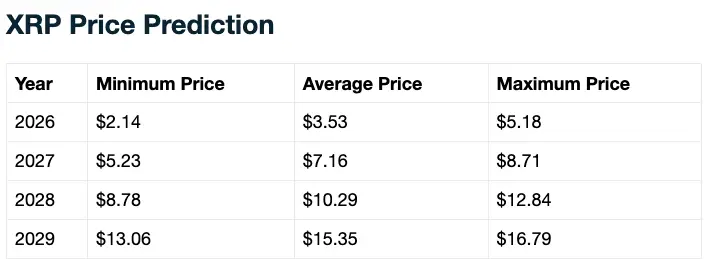

According to Telegaon analysts, XRP will have a bullish year in 2026. The platform anticipates the asset to hit a potential maximum price of $5.18. Hitting $5.18 would be a new all-time high for the asset, and reaching this level will entail a rally of about 172.6%.

Also Read: Ripple XRP to Rally if U.S. Crypto Market Structure Bill is Approved?

However, we are still in a bear market, and cryptocurrencies are struggling to gain momentum. XRP’s price could face substantial challenges from the ongoing geopolitical tensions and macroeconomic uncertainties. President Trump’s additional tariffs on countries supporting Greenland could lead to further market corrections.