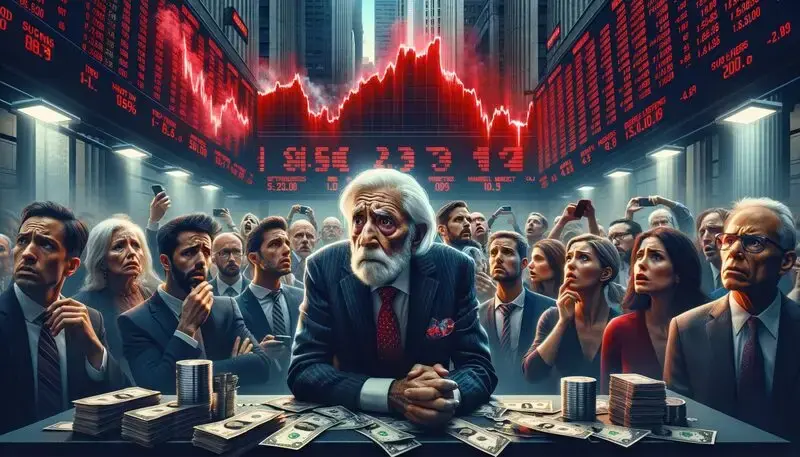

The US markets are bleeding profusely, flashing their most pungent red as of now. The stock market and cryptocurrency domain are suffering losses in the billions, as markets opened with a significant loss streak earlier today. Why are markets crashing all of a sudden? Here are the key reasons compelling the markets to bleed significantly.

Also Read: Dalio Warns: Bitcoin Isn’t Built for Major Reserve Status

Why Are Markets Down Today?

Crypto markets, alongside the US stock markets, have opened to utter chaos and mayhem today. Billions have been liquidated as markets flashed their deepest shade of red, running on speculations and anticipations of new federal developments.

As per the latest Kobeissi letter update, the latest market crash has swept the market due to the US labor department sharing how it will release its November-December data on December 16th. Later on, the news of the Federal Reserve considering a potential December rate cut hit the markets with full force, deepening the mayhem further. The portal called these new updates a form of information asymmetry, leading the markets to come to a standstill and crash rapidly.

“WHY are markets crashing? Our logical explanation: At 11:20 AM ET, the US Labor Department said the November and October employment “situation” will be released on December 16th... However, in the 40 minutes after this announcement, the S&P 500 crashed another -120 points. We now know that the Fed is effectively entering another interest rate decision with an economic data blackout. Markets do NOT like information asymmetry.

Trillions Wiped Out In Minutes

The speculations mentioned above have hit the markets with full force, resulting in trillions being wiped out. The markets are now projecting volatility, with KL explaining that investor sentiment has switched to panic mode, leaving them on edge and pushing them to exit such a volatile market.

“But, is this really enough to erase nearly -$2 trillion in market cap in a matter of minutes? In our view, this was just the “switch” that shifted sentiment. The reality is that investors are on edge in this market. When a sudden decline begins, investors rush to the exit because the “bubble is popping.” This works in the opposite direction as well. When stocks surge, the rally accelerates quickly as capital rotates back into AI stocks because. AI is the next big thing.” The reality is that we now live in a market where ANY headline can drive trillions of dollars of market cap in a matter of minutes for one sole reason. Sentiment is more polarized than ever.”

Also Read: How Much Shiba Inu (SHIB) Could Change Your Life by 2026?