The month of September has begun and has brought forth a bag full of speculations of a possible rate cut that might be on the cards this month. The speculative regimens are running nonstop, speculating whether September might be the month where the Federal Reserve finally announces the highly anticipated interest rate cut, intending to normalize stagflation and inflation prospects. If the Fed ends up making this announcement, here’s the list of common assets, the ones that may soar or tank as new interest rate cuts pave their way into the market.

Also Read: Ukraine Passes Cryptocurrency Legalization And Tax Bill

Pressure on Powell Builds to the Hilt

Notable economic experts and analysts are anticipating the Federal Reserve to cut interest rates in September 2025. The calls to cut rates have now intensified, with Fed Governor Chris Waller supporting the fact that the reserve must cut rates in its next meeting.

“JUST IN: Fed Governor Chris Waller SUPPORTS SLASHING interest rates at the upcoming Federal Reserve meeting. “We need to start cutting rates at the next meeting… Over the next 3-6 months, we could see multiple cuts coming in.” Jerome Powell is TOO LATE and is costing us many billions.”

🚨 JUST IN: Fed Governor Chris Waller SUPPORTS SLASHING interest rates at the upcoming Federal Reserve meeting.

— Eric Daugherty (@EricLDaugh) September 3, 2025

"We need to start cutting rates at the next meeting… Over the next 3-6 months, we could see multiple cuts coming in."

Jerome Powell is TOO LATE, and is costing us… pic.twitter.com/6GcDNYbMaS

Moreover, President Donald Trump has also been pressuring the Fed to cut rates as soon as possible, urging Jerome Powell to lower the rates at the earliest.

“There’s an 80% probability of an interest rate cut from Jerome Powell next month, but he should cut by more than just 0.25%. Why? Since President Trump took office, inflation has annualized at just 1.9%. When @Pulte says that the Fed is hallucinating about the data, he’s right.”

There's an 80% probability of an interest rate cut from Jerome Powell next month, but he should cut by more than just 0.25%. Why? Since President Trump took office inflation has annualized just 1.9%. When @Pulte says that the Fed is hallucinating about the data, he's right. pic.twitter.com/4GN42q8p8M

— James Fishback (@j_fishback) August 19, 2025

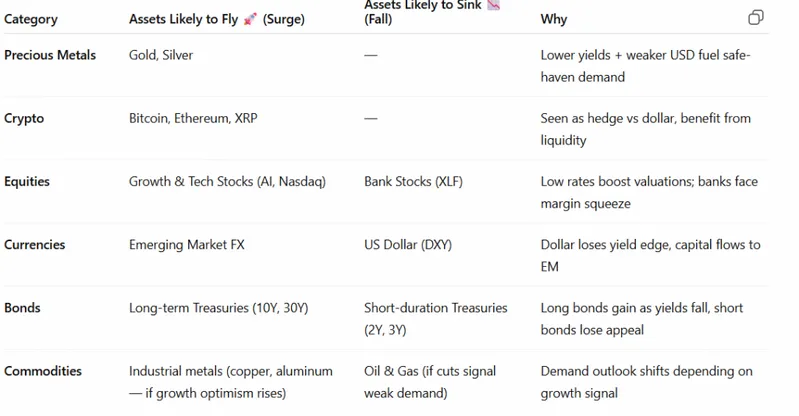

Which Assets May Fly or Tank Once Interest Rates Are Cut

Once the interest rate cuts are announced, or perhaps have been lowered to stabilize the US economy, the assets that may surge tremendously include:

- Gold

- Silver

- Growth Stocks

- Cryptocurrencies such as Bitcoin and Ethereum

When interest rate cuts are announced, especially when they are lower than their current metric, it makes USD-backed assets appear non-lucrative in the long run. This process is pivotal for investor sentiment towards safe haven assets such as gold, silver, Bitcoin, and growth stocks, helping their price surge in the process.

The assets that may tank once the interest rates are lowered include:

- US dollar (DXY)

- Bank stocks (XLF)

- Short-duration treasuries

- Energy sector oil and gas

The rate cuts, when lowered, impact the overall economic progress narrative. This may take a toll on the US dollar’s value, which may manifest in the form of low DXY index projections, pushing the investor volume towards non-USD-backed assets.

Also Read: China Meet: Putin Calls For Global Power Shift, Backs Multipolar World