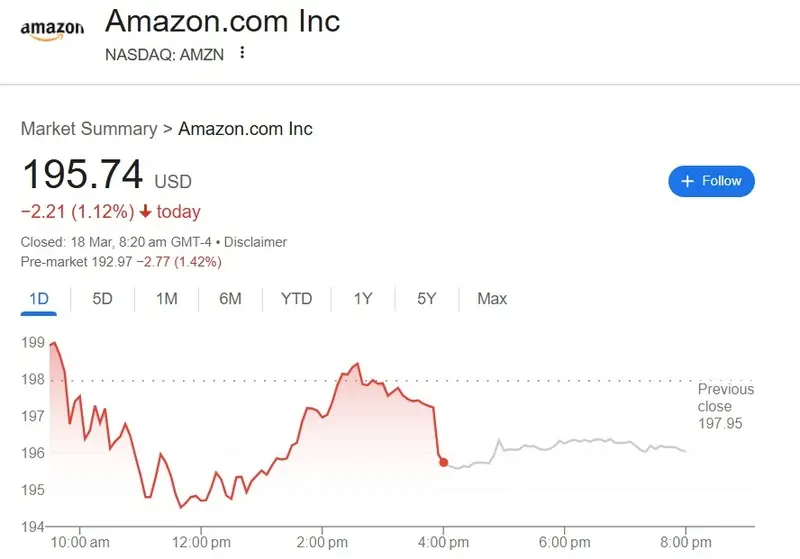

Amazon stock is currently trading at the $195 level and is attracting bearish sentiments in the charts. AMZN has dipped double-digits in a month losing nearly 14% of its value. It fell from a yearly high of $242 and is now struggling to climb above the $200 mark. The stock is under the bearish traps as the broader stock market is sending mixed reactions to Trump’s tariffs. The ongoing trade wars are disrupting the market leading to top companies shedding the gains that it generated last year.

Also Read: 2 Reasons Why Shiba Inu (SHIB) ETFs Should Become a Reality

Amazon Stock: What Will AMZN’s Value Be 1 Year From Today?

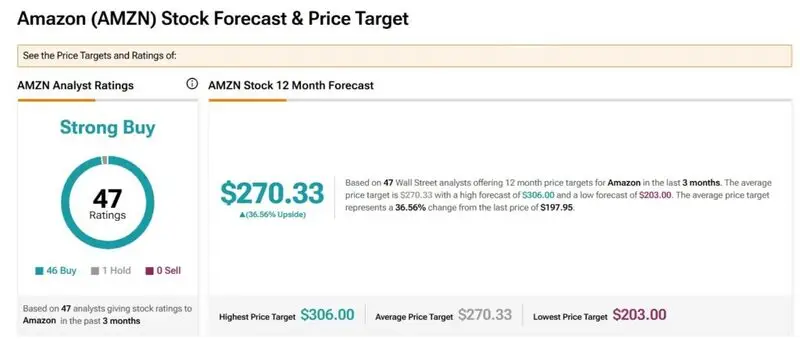

Leading stock market price prediction and analytic firm TipRanks has painted a bullish picture for Amazon stock. According to the price prediction, AMZN could surge much higher in value in the next 12 months. Therefore, taking an entry position now when the price is below $200 could be beneficial.

Also Read: XRP Price Prediction: Where Is It Headed By 2027?

According to the price prediction, AMZN could reach a maximum high of $306 within the next 12 months. The average trading price for Amazon stock could be around the $270 mark in 2026. That’s an uptick and return on investment (ROI) of approximately 38% from its current price of $195. An investment of $1,000 could turn into $1,380 in the next 12 months if the forecast turns accurate.

“Based on 47 Wall Street analysts offering 12-month price targets for Amazon stock in the last 3 months. The average price target is $270 with a high forecast of $306 and a low forecast of $203. The average price target represents a 38.11% change from the last price of $195,” read the forecast.

Also Read: Pi Network’s PI Token Plummets: Will It Fall Below $1 Soon?

Among the 47 Wall Street strategists, 46 of them have given Amazon stock the ‘buy’ call and 1 ‘hold’ call. None of the analysts have given a ‘sell’ call indicating that AMZN is now available at discounted prices.