Nvidia Q3 earnings show a mix of wins and losses. The tech giant saw its stock fall 3% due to lower profit margins. This happened despite strong AI growth numbers. The company’s tech market volatility sparked new concerns after Q3 fiscal 2025 earnings hit $35.08 billion amid rising competition and changing market dynamics.

Also Read: Shiba Inu: Can SHIB Hit $0.0001 If Bitcoin Hits $125,000?

Nvidia Q3 earnings drop sparks concerns over NVDA stock, AI growth, and tech market stability

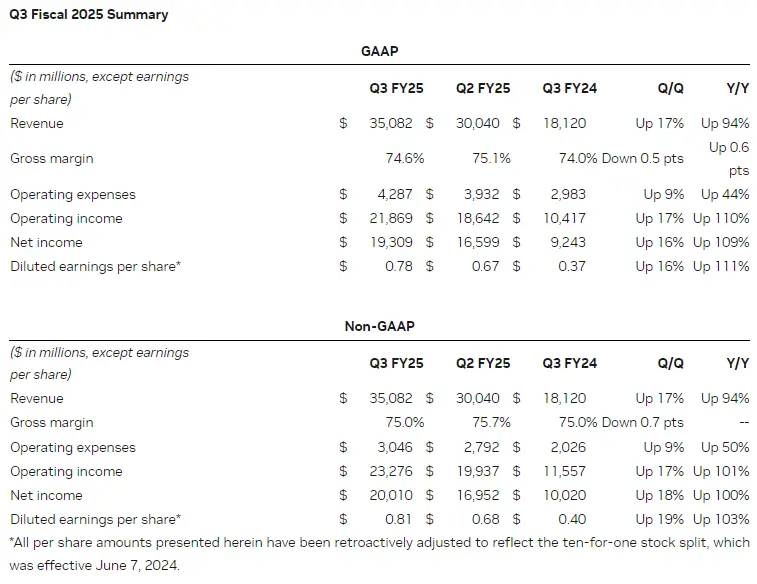

Record Revenue Overshadowed by Margin Concerns

Revenue jumped 94% from last year to $35.08 billion, but NVDA stock took a hit. Profit margins dropped from 75.1% to 74.6% last quarter and are expected to fall further to 73.0% in Q4. These numbers raised questions about tech market stability as investors looked at growth versus profit trends and long-term sustainability.

Data Center Growth and AI Market Impact

The data center segment grew to $30.8 billion, a 112% rise from last year. Tech market volatility spread to crypto markets, and AI-related tokens fell 6% in market value. NVDA stock movements showed investors worried about rising industry competition and market share challenges.

Also Read: De-Dollarization: How Long Will the US Dollar Remain Global Currency?

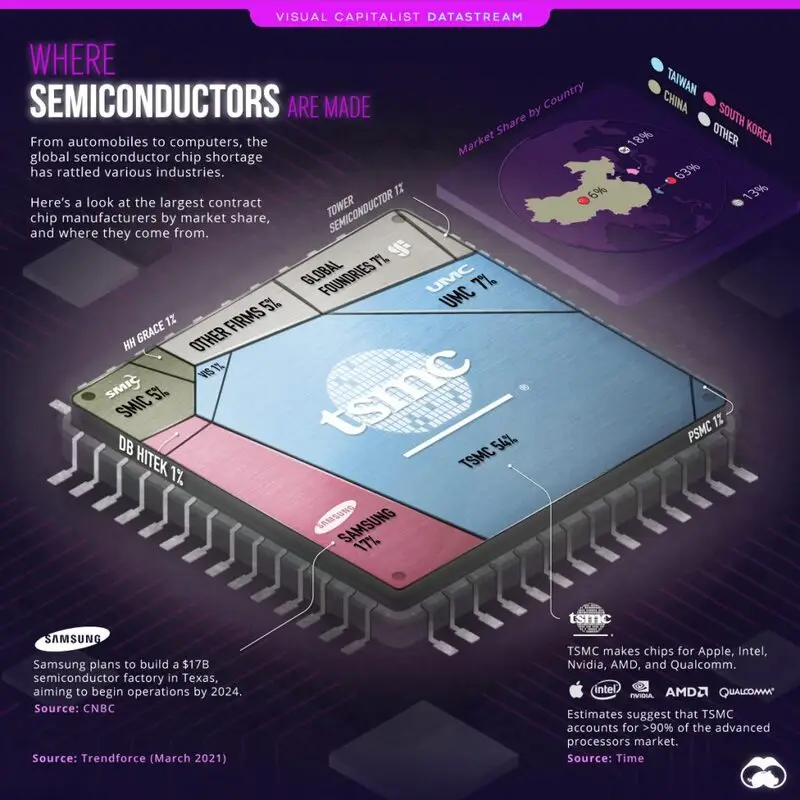

Competition Intensifies in the AI Chip Market

Nvidia now ranks third in chip profit margins, behind Arm Holdings and Broadcom. This shows growing pressure in the AI growth sector. The company spent 44% more than last year, reaching $4.287 billion. Most research is to stay ahead in the market and maintain technological advantages.

Future Outlook and Market Response

Nvidia expects $37.5 billion in Q4 revenue. CEO Jensen Huang said that AI is “transforming every industry, company, and country” as enterprises integrate AI into their workflows, with Nvidia set to benefit as computing scale grows “exponentially.”

At the Q3 earnings call, he added: “The age of AI is upon us, and it’s large and diverse. Nvidia’s expertise, scale, and ability to deliver full stack and full infrastructure let us serve the entire multi-trillion-dollar AI and robotics opportunities ahead, from every hyperscale cloud, enterprise private cloud, to sovereign regional AI clouds, on (premise) to industrial edge, and robotics.” Tech market stability remains uncertain. Investors watch both growth potential and rising competition.

Also Read: Ripple XRP Vs. Cardano: Which Will Hit An All-Time High First?