Chainlink whale accumulation has surged as LINK tests the $18 support level, with on-chain data revealing major buy signals from large-scale investors. The 30-day MVRV ratio dropped below -5% on October 17, 2025, entering what analysts describe as an optimal accumulation zone. As Chainlink whale accumulation intensifies, LINK price prediction models suggest potential movement toward $25 if current buying pressure continues.

Chainlink Whale Accumulation Signals Bullish Move Toward $25 Breakout

MVRV Buy Signal Triggers Whale Activity

The Market Value to Realized Value ratio for Chainlink whale accumulation has flashed a major buy signal. This technical metric shows most short-term investors are currently at a loss, which historically tends to be the phase when whales start accumulating. The price jumped 9.5% following the signal.

Michaël van de Poppe had this to say:

“The LINK/BTC price structure shows signs of a major breakout ahead.”

Chainlink $18 support has held firm, with the Chainlink staking upgrade reducing selling pressure while CCIP protocol adoption expands across applications.

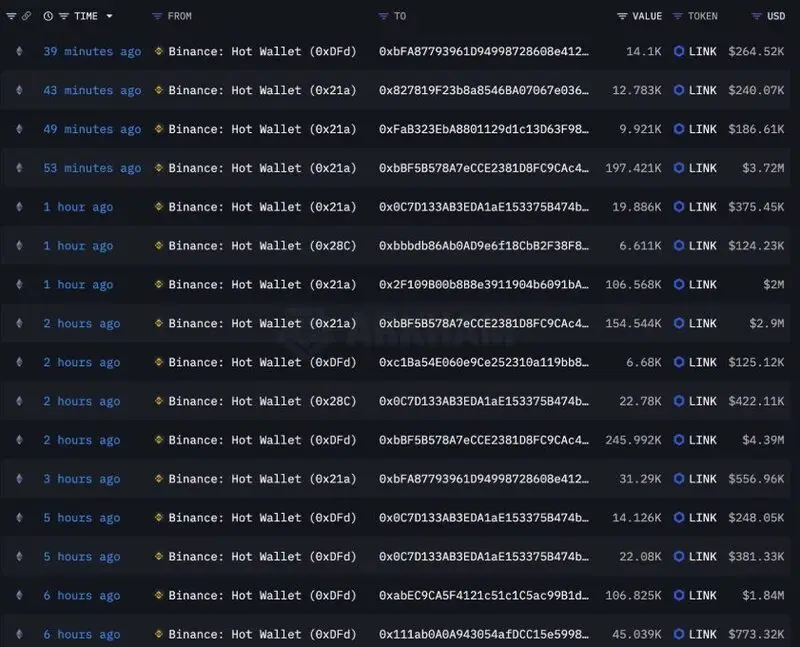

Massive Whale Transactions Signal Strategic Positioning

Blockchain data reveals significant Chainlink whale accumulation through multiple large transactions. Binance hot wallets processed 197,421 LINK worth $3.72 million and 245,992 LINK totaling $4.39 million. Whales have been withdrawing LINK from exchanges, interpreted as long-term holdings.

Also Read: Should You Worry About Chainlink’s 20% Weekly Price Crash?

This Chainlink whale accumulation pattern, coinciding with Chainlink $18 support tests, indicates sophisticated investors view current prices as attractive. The Chainlink staking upgrade has enhanced network security while CCIP protocol adoption provides fundamental utility.

Expert Outlook Supports LINK Price Prediction

Daan Crypto Trades stated:

“Chainlink has historically outperformed the altcoin index (TOTAL2) during strong market rallies since 2021. Each time a similar accumulation pattern appears, LINK is often among the first tokens to lead the next wave.”

Chainlink development is at the head of Real World Assets with 372.03 GitHub commits in the past 30 days. This long-term growth underpins LINK price prediction models. Whale buying, Chainlink $18 support, the Chainlink staking upgrade, and adoption of the CCIP protocol all combine to paint a possibly bullish picture.

Also Read: Chainlink: What Does a $1,000 LINK Investment Earn You in 2026