Warren Buffett retires after decades at the helm of Berkshire Hathaway, and right now, investors around the world are questioning what this means for the company’s future direction. The legendary investor’s departure, which was announced just last week, has already sent ripples through the financial markets and sparked discussions about the post-Buffett era.

Also Read: Pi Coin on the Verge of $1 with Huge Announcement Set for May 14

What Buffett’s Exit Means for Berkshire Stock and Your Portfolio

At the time of writing, Berkshire Hathaway’s stock, has shown some sign of volatility since the retirement announcement by Warren Buffett. The changeover to new leadership under Greg Abel will be closely monitored by investors who can legitimately fear what the future of Berkshire Hathaway’s investment policy will be without Buffett.

Keith Speights of The Motley Fool stated:

“Berkshire Hathaway won’t suddenly undergo a radical transformation. The company’s decentralized structure means most of its businesses will continue to operate just as they have been.”

Succession Plans and Market Impact

Warren Buffett previously confirmed his succession plans during a Berkshire annual meeting, when he said:

“The directors are in agreement that if something were to happen to me tonight, it would be Greg who’d take over tomorrow morning.”

Also Read: Dogecoin Predicted to Rally 57% to $0.30: Here’s When

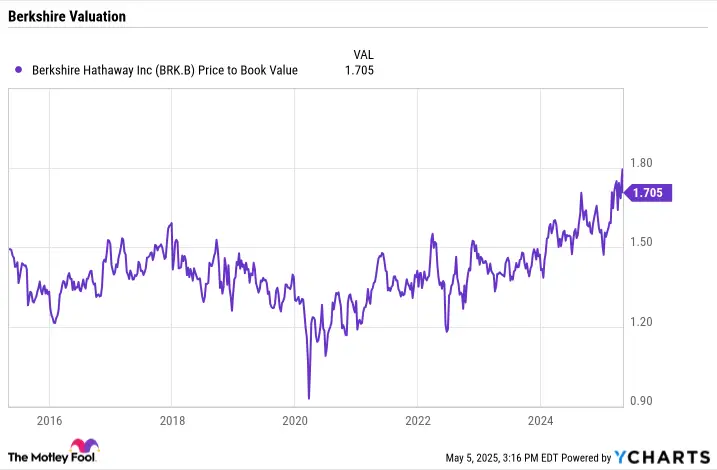

Berkshire Hathaway can count on the company’s future now only if the young Abel manages to preserve the prudent investment policy of the company establishing at the same time the new strategies perhaps of his own. This transition seems to reflect a certain measure of investor uncertainty as indicated by the stock’s current price-to-book value ratio of 1.705, which is significantly higher than its long term average.

Investment Strategy After Buffett

Warren Buffett retires at a moment when Berkshire actually holds over $157 billion in cash reserves. How these substantial funds get deployed in the coming months and years will probably signal the new leadership’s approach to finding and seizing investment opportunities.

Michael Peterson, portfolio manager at Peterson Capital Management, suggested:

“The next CEO might be more willing to pay a dividend when the cash pile grows too large. This would represent a significant shift from Buffett’s approach, who always preferred to hold cash for major acquisition opportunities.”

Shareholders of Berkshire should revisit their position while at the same time avoiding doing anything in hasty. The company’s varied business interests and robust balance sheet still offers a reasonable amount of stability even at this uncertain time of transition.

Long-Term Outlook

While Warren Buffett retires after an extraordinary career, Berkshire Hathaway’s fundamental strengths remain largely intact. The post-Buffett investment strategy will likely evolve gradually rather than change dramatically overnight.

Also Read: SEC Moves to End Ripple Case as Commissioner Rebels: $75M Returns to XRP Giant

Thomas Reynolds, CEO of Beacon Investment Advisors, said:

“Companies with decentralized operations and strong subsidiary management tend to weather leadership changes better than those with centralized decision-making. Berkshire exemplifies this model, which should provide continuity despite Buffett’s outsized influence.”

Berkshire Hathaway’s future leadership inherited by Abel operates within a sound framework that has been cultivated over a number of decades even as markets adapt to life after Buffett’s retirement.