Amazon stock (NASDAQ: AMZN) crashed 5% on Friday after Trump announced 100% tariffs on all Chinese goods entering the US. The US stock market plunged in value, erasing more than $1.65 trillion worth of investors’ money before Friday’s closing bell. The trade wars are impacting the performance of the stock market, causing traders to be nervous about their investments. While some view the crash as a buying opportunity, others believe the downturn is yet to come to an end. Despite all the noise, the Wall Street Journal is confident that Amazon stock could deliver gains in the next 12 months.

Also Read: Meta Stock: Analysts Call it a Strong Buy Before Q3 Earnings

Amazon Stock: Wall Street Journal Predicts 42% Gains For AMZN

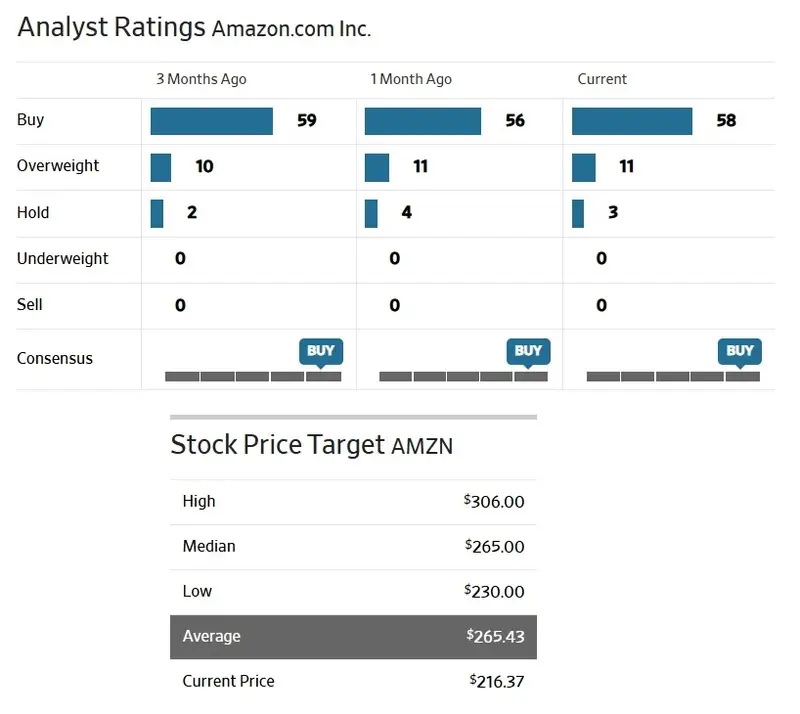

The Wall Street Journal remains bullish on Amazon’s stock prospects as analysts give it a ‘buy’ call. AMZN is currently trading at the $216 level and is down 1.75% year-to-date. It entered January at $220 and is down by $4 even after 10 months. However, it had fallen to the $167 level on Trump’s Liberation Day market crash in April. It’s up 29% since April’s market crash, and investors who took an entry position then remain in profits.

According to the Wall Street Journal price prediction, Amazon’s stock could reach a high of $306 within the next 12 months. That’s an uptick and return on investment (ROI) of approximately 42% from its current price of $216. Therefore, an investment of $1,000 could turn into $1,420 by next year if the forecast turns out to be accurate.

Also Read: AMD Stock Falls On New China Tariff Threats

Around 58 Wall Street Journal analysts have given a ‘buy’ call for Amazon stock. Only 11 analysts have said that AMZN is ‘Overweight’ and should be avoided. Also, 3 strategists have given a ‘hold’ call, urging traders not to sell AMZN. In conclusion, the overall consensus for AMZN is ‘buy’ with a price target of $306 with an uptick of 42%.