The Wall Street crash has totally rocked financial markets, wiping out around $320 billion in value and also sending major shockwaves through various investment portfolios. The S&P 500 has actually dropped more than 9%, with the Nasdaq falling about 13% at the time of writing. This market volatility has extensively exposed investors to significant security risks and substantial financial loss while simultaneously creating numerous opportunities for investment scams to flourish in the current economic climate.

Also Read: Market Dip Alert: 3 Bargain Stocks with High Growth Potential

Understanding Market Volatility and Investment Options Amid Wall Street’s $320B Crash

Tech Giants Decimated

The Wall Street crash has really hit technology companies the hardest lately. Nvidia has tumbled over 20% recently, Tesla basically crashed 36%, and Palantir has lost around 30%. Banks weren’t really spared either, with Citigroup, Morgan Stanley, and Goldman Sachs all experiencing declines of approximately 20% as recession fears continue to intensify across various major financial sectors at the time of writing.

Goldman Sachs analyst David Kostin stated:

“The ‘Magnificent Seven’ accounted for more than half of the total correction, but the market’s problems extend far beyond those stocks.”

Buffett’s Exit From The Market

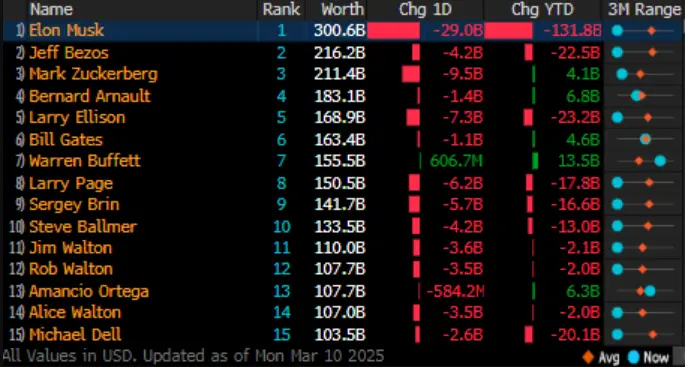

During this devastating Wall Street crash, Warren Buffett strategically positioned himself as the sole survivor among major investors. His decisive action to divest billions in Apple, Bank of America, and Citigroup stocks before the market collapse effectively insulated him from the substantial financial losses experienced across numerous investment portfolios throughout this turbulent economic period. His cash reserves, which are quite substantial at this point, now total around $334 billion in value, which is approximately one-third of Berkshire Hathaway’s overall portfolio value.

Also Read: BNB Price Surge: $580 Breakthrough with 6.19% Rise – Key Drivers

Defensive Investments Rising

Not all sectors have actually suffered in the Wall Street crash, you know? Defensive stocks have kinda thrived amid the intense market volatility, with American Water Works up about 12% and Merck & Co climbing around 11% or so. Steel companies like US Steel have also gained from Trump’s trade policies and stuff.

Consumer confidence has dramatically plummeted throughout the recent Wall Street crash, with February registering the most significant one-month decline since the pandemic across multiple critical economic indicators. Investment scams have aggressively multiplied during this market turmoil as desperate investors increasingly pursue alternative opportunities within various unregulated market environments.

Bond markets are, like, pricing in several interest rate cuts right now, indicating Wall Street expects weaker growth and such. This economic uncertainty dramatically increases security risks for investors caught in the crash at this point in time.

President Donald Trump admitted:

“I’m not ruling out a recession for this year.”

The Wall Street crash has effectively recalibrated market valuations globally and stuff. The S&P 500’s forward price-earnings ratio has also substantially decreased from 26x to 21x. At the same time, European stocks have modestly declined from 15x to 14x, indicating that the investors are strategically reevaluating their positions during one of the most persistent market volatility periods and escalating financial loss concerns across numerous significant investment categories.

Also Read: Dogecoin: $550 Worth Of DOGE Becomes $1 Million Today