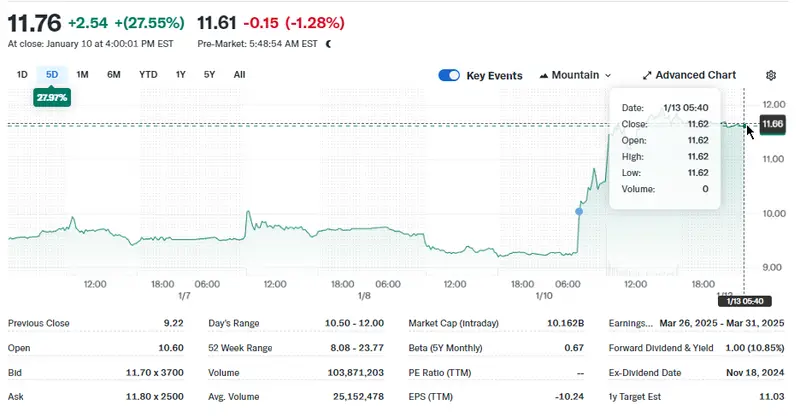

What happened is that Walgreens stock rose 27% to $11.76 last week. We see better news about prescription payments and store closings. The WBA stock beat all the market predictions. The company can make more money soon, while the latest Walgreens stock analysis shows some interesting recovery signs.

Also Read: Ethereum’s Major Breakout: Can ETH Hit $4,811 or $8,550 Next?

Understand Walgreens’s Stock Surge, Investment Risks, and Future Growth

Store Closures and Cost-Cutting Moves

CEO Tim Wentworth shared shows progress on closing stores. Their plan to close 1,200 weak stores moves faster than planned. “We succeeded in modifying contracts with commercial insurance firms that pay for prescriptions, including Medicare and Medicaid,” Wentworth stated. WBA stock news confirms that 70 stores closed in early 2025, and unfortunately, another 500 will close this year. These changes mean more profits soon.

Better Prescription Deals

The company was lucky enough to get better deals with insurance companies and Medicare. This action fixes a large problem in their business, while they also earned $0.51 per share, which beat the stated $0.40 target. Should you buy Walgreens stock now? What many experts see suggests future growth potential.

Also Read: Can SUI Hit $10 in January 2025?

Money Situation

What marks the Walgreens stock recovery includes some risks. CFO Manmohan Mahajan said, “We’ve seen improvements in free cash flow due to better operating performance and reduced capital expenditures.” What remains true is the stock rose but problems exist. Store sales grew 6.6%. What concerns experts is profit margins fell from 4% to 1.3%. Healthcare lost $325 million. The company lost $245 million in total.

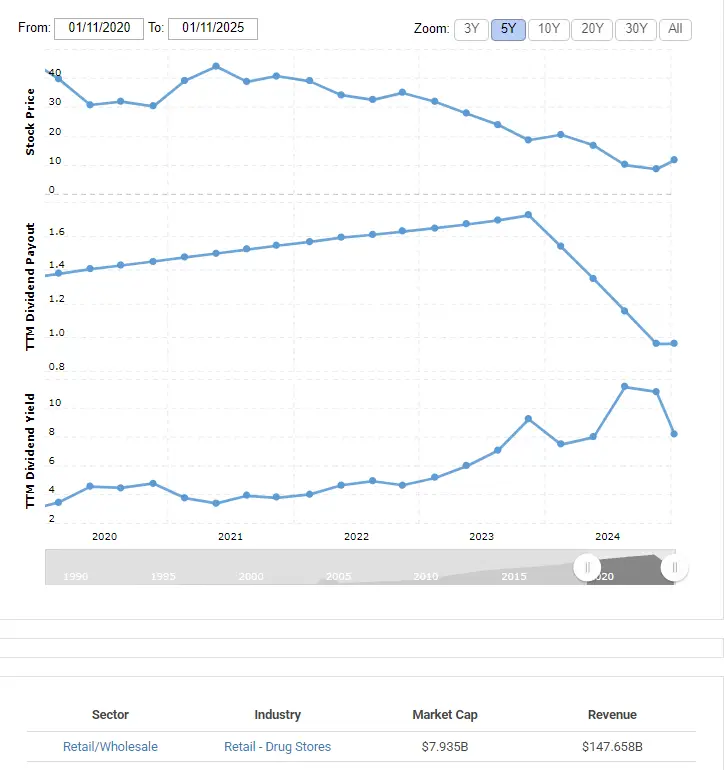

Dividends and Investment Talk

What WBA stock offers is an 8.5% dividend yield. What experts warn is this might drop from low profits. Evercore’s Elizabeth Anderson noted “surprisingly strong results from retail operations.” She raised the price target to $12. What JPMorgan’s Chris Schott said was “a period of max uncertainty.” What current prices suggest is room to grow.

Also Read: Trump’s Treasury Pick Reveals $500K Bitcoin Stake via BlackRock ETF