According to a report by VanEck, Bitcoin’s (BTC) hash rate has dropped 4%, the sharpest dip since April 2024. Hash rate dips are a bullish signal, and could indicate that BTC is nearing its bottom. The firm also noted that digital asset treasuries (DAT) added 42,000 BTC, the largest accumulation since July 2025. Moreover, long-term holders are not giving in to the selling pressure. All three developments could mean that Bitcoin (BTC) may be gearing up for a price reversal.

Is Bitcoin Entering a Price Reversal Phase?

VanEck is not the only institution with an optimistic outlook for Bitcoin (BTC). Grayscale and Bernstein also anticipate BTC to break out in 2026. Both Grayscale and Bernstein claim that BTC may be following a 5-year cycle, instead of its regular 4-year path. This means that Bitcoin (BTC) could climb to a new all-time high in 2026, five years after its 2021 peak. Bernstein anticipates BTC to hit $150,000 in 2026 and $200,000 in 2027.

While VanEck, Grayscale, and Bernstein present bullish outlooks for Bitcoin (BTC), Barclays, on the other hand, is quite pessimistic about the 2026 crypto market. Barclays anticipates the crypto sector to face additional struggles next year. The financial institution cites low spot trading volumes and low demand for its bearish outlook.

Also Read: Bitcoin Attempts To Reclaim $90,000, Will It?

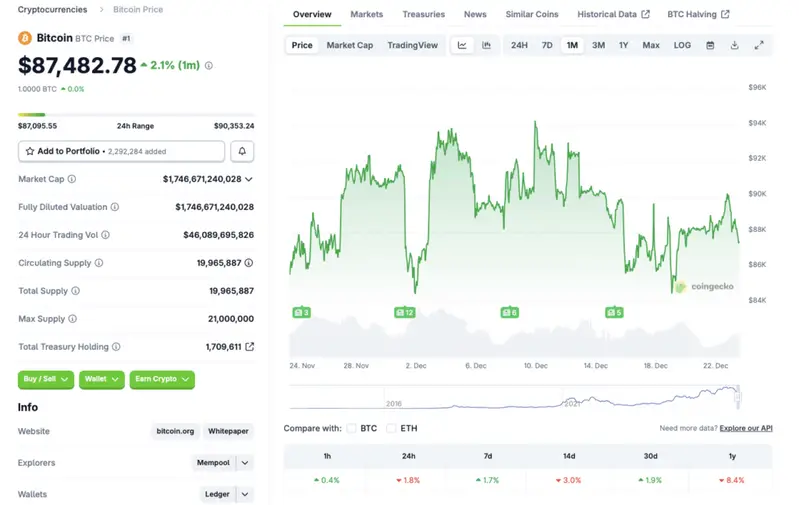

The crypto market has struggled to gain momentum over the last few months, despite two interest rate cuts since October. Bitcoin (BTC) is currently facing substantial resistance at the $90,000 level. The current market scenario is attributed to macroeconomic uncertainties. Market participants seem to be taking a risk-off approach. The development is further strengthened by growing gold and silver prices. Bitcoin (BTC) may continue its lackluster path until economic conditions improve. According to CoinGecko’s BTC data, the original crypto has seen a 1.7% rally in the weekly charts and a 1.9% rally over the previous month. However, BTC is still down by 1.8% in the daily charts, 3% in the 14-day charts, and 8.4% sicne December 2024.