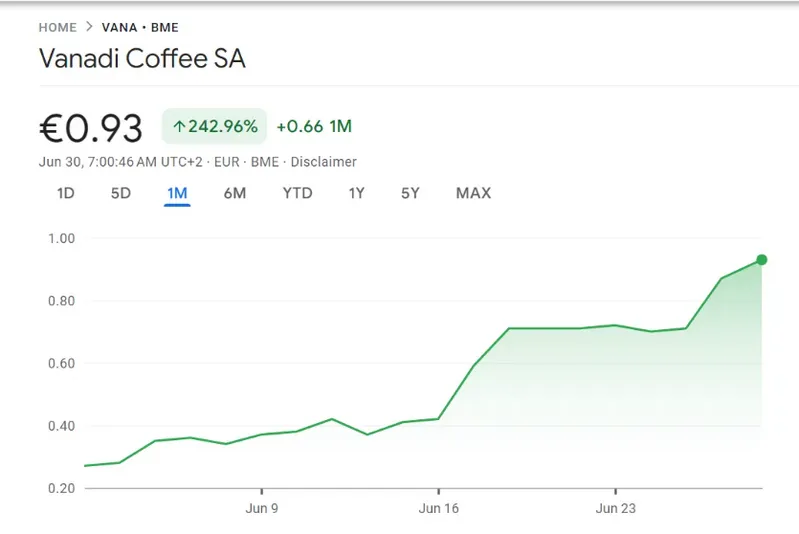

Vanadi Coffee‘s Bitcoin treasury strategy has driven a remarkable 242% stock surge following shareholder approval of a €1.1 billion Bitcoin investment plan. The Spanish coffee chain’s Vanadi Coffee stock surge reflects growing investor confidence in corporate cryptocurrency adoption, despite the company’s ongoing financial challenges and also cryptocurrency market volatility concerns that many investors face right now.

Also Read: JPMorgan Launches New Stock Market Forecast Model, Shocking Signal

Vanadi Coffee Bitcoin Treasury Plan Drives Stock Surge Amid Market Volatility

The Vanadi Coffee Bitcoin treasury plan was unanimously approved by shareholders on June 29, 2025, and it authorized the board to pursue Bitcoin investment risks worth up to €1 billion. This ambitious strategy aims to transform the struggling Alicante-based coffee chain into Spain’s largest Bitcoin-holding company, despite reporting €3.3 million in losses during 2024, which represents an increase of 15.8% from the previous year.

The company has already purchased 54 BTC valued at approximately €5.8 million, with assets held in custody by Bit2Me exchange. The Vanadi Coffee stock surge demonstrates how cryptocurrency market volatility can create dramatic price movements when companies announce Bitcoin treasury strategies, and also shows investor appetite for such moves.

Financial Strategy Shift Drives Bitcoin Investment

Chairman Salvador Martí leads this transformation of the Vanadi Coffee Bitcoin treasury approach, and he seeks to replicate successful models from companies like Strategy and also Metaplanet. The Bitcoin treasury plan represents a calculated response to mounting financial pressures and rising operational costs that have been affecting the business.

The company stated:

“Similar to companies such as Strategy or Metaplanet, Vanadi Coffee redefines its business model and will use Bitcoin as its main reserve asset and accumulate large amounts of Bitcoin as part of its treasury.”

Andrew Bailey, senior fellow at the Bitcoin Policy Institute, expressed skepticism about the strategy and had this to say:

“Most new ‘bitcoin treasury companies’ are gimmicks, and will likely fail. Though there are diseconomies of scale that privilege new entrants, a badly run business doesn’t become a good one just because it is acquiring sound money.”

The Vanadi Coffee stock surge reflects broader market enthusiasm for Bitcoin investment risks, though critics warn about the scale of ambition relative to the company’s six-location operations. Directors received authorization to increase capital by 50% and also negotiate convertible debt financing, which could potentially dilute existing shareholders while pursuing the ambitious cryptocurrency market volatility strategy.

Also Read: Metaplanet Issues $208 Million Bonds To Buy More Bitcoin

Despite financial struggles, the Vanadi Coffee Bitcoin treasury plan positions the company at the forefront of corporate cryptocurrency adoption in Spain right now, though success remains uncertain given the inherent Bitcoin investment risks and also ongoing cryptocurrency market volatility challenges facing the digital asset space at the time of writing.