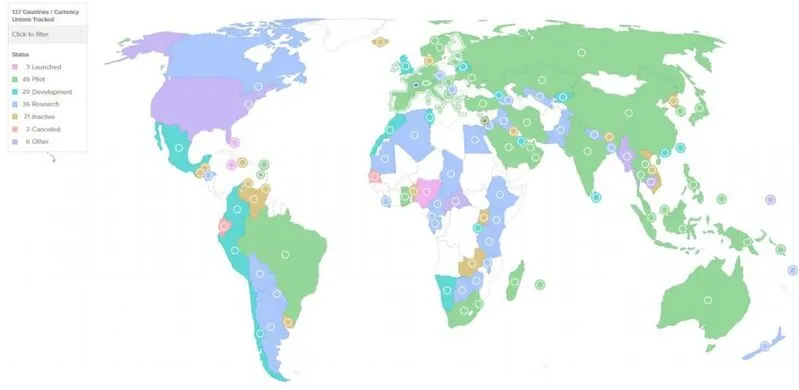

The US CBDC ban vote has actually created a historic shift in digital currency policy as lawmakers passed anti-CBDC legislation through the Clarity for Payments Act. With the Bank of England CBDC project facing abandonment right now and rising Central Bank Digital Currency risks, this anti-CBDC legislation marks a pivotal moment for financial privacy advocates worldwide.

Also Read: South Korea Pauses CBDC Testing to Prioritize Won-Backed Stablecoin

US CBDC Ban Vote and UK Exit Signal Global Anti-CBDC Shift

The US CBDC ban vote was passed by the House after nearly 10 hours of debate, with 217 Republicans supporting the Clarity for Payments Act along with companion anti-CBDC legislation. This Central Bank Digital Currency risks mitigation effort gained momentum when President Trump actually intervened with holdout Republicans who initially blocked the Bank of England CBDC-style surveillance measures.

Bank of England Abandons Digital Currency Plans

The Bank of England CBDC project is facing potential cancellation as Governor Andrew Bailey expressed skepticism about its necessity right now. Bailey had this to say during a Parliamentary hearing:

“I think that’s a sensible place to do it. If that’s a success, I question why we need to introduce a new form of money.”

This actually represents a dramatic reversal from the BoE’s 2023 position when Bailey stated:

“On the basis of our work to date, the Bank of England and HM Treasury judge that it is likely a digital pound will be needed in the future.”

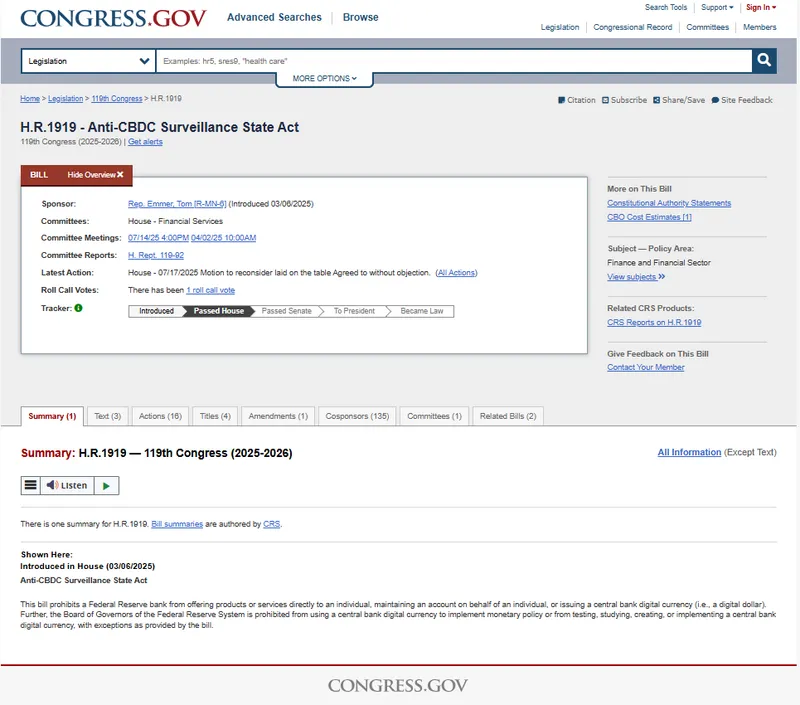

Anti-CBDC Legislation Gains Bipartisan Support

The US CBDC ban vote succeeded through the Anti-CBDC Surveillance State Act, which was championed by Majority Whip Tom Emmer. He stated:

“Attaching our Anti-CBDC Surveillance State Act to the NDAA will ensure unelected bureaucrats are NEVER allowed to trade Americans’ financial privacy for a CCP-style surveillance tool.”

The Clarity for Payments Act was passed with 294 votes, including 78 Democrats, while the anti-CBDC legislation passed 219-210. These Central Bank Digital Currency risks concerns actually reflect growing privacy fears about government financial surveillance capabilities.

Done. We blocked (in collaboration with law enforcement) the 85,977 USDt stolen. https://t.co/TI9DgDL6bY

— Paolo Ardoino 🤖 (@paoloardoino) July 20, 2025

Recent Tether actions have highlighted surveillance concerns, with CEO Paolo Ardoino stating:

“We blocked (in collaboration with law enforcement) the $5,977 USDT stolen.”

Can anybody explain how this isn’t exactly what a CBDC is? We are cheering for completed financial surveillance being used indirectly by the government.

— Fiatnam Veteran (@FiatnamVeteran) July 20, 2025

Social media users have raised questions about centralized control, with one posting:

“Can anybody explain how this isn’t exactly what a CBDC is? We are cheering for completed financial surveillance being used indirectly by the government.”

Also Read: US House Officially Passes GENIUS, Clarity And Anti-CBDC Acts

The US CBDC ban vote represents the first major cryptocurrency legislation in American history right now, establishing clear boundaries against government-issued digital currencies while the Bank of England CBDC project faces similar resistance. This anti-CBDC legislation addresses mounting Central Bank Digital Currency risks through the comprehensive Clarity for Payments Act framework that lawmakers developed.