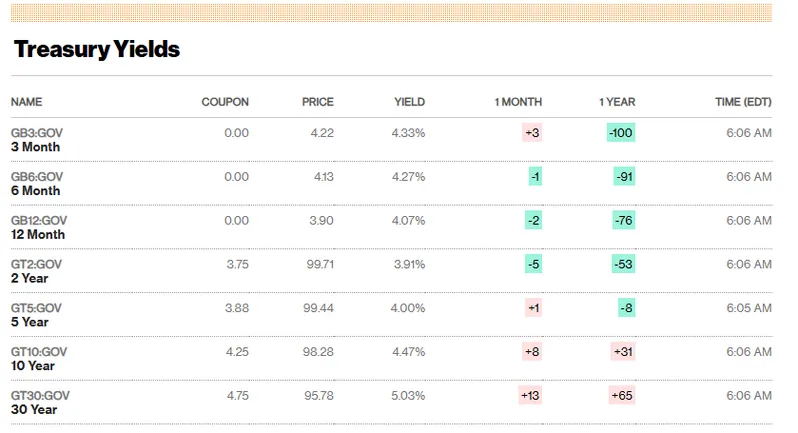

US Treasury yields spike reached critical levels Thursday as the 10-year treasury yield rose 1.4 basis points to 4.47% while the 2-year treasury yield actually climbed 2.2 basis points to 3.91%. This US Treasury yields spike has intensified market volatility impact and heightened inflation concerns US across financial markets right now.

US Treasury Yields Spike Fuel Market Volatility and Inflation Concerns

The recent US Treasury yields spike reflects growing uncertainty about monetary policy and also the economic outlook. The 10-year treasury yield movement of 1.4 basis points signals investor concerns about long-term economic stability, while the 2-year treasury yield’s larger 2.2 basis point increase suggests shifting near-term expectations.

Also Read: US Treasury Removes Crypto Broker Reporting Rules- Bloomberg

Market Dynamics Behind the Spike

This US Treasury yields spike comes amid broader market volatility impact affecting global indices. The 10-year treasury yield reaching 4.47% actually represents a significant threshold for bond markets, as inflation concerns US continue to influence investor sentiment and trading patterns at the time of writing.

Joe Brusuelas, principal and chief economist for RSM, stated:

“Erosion of the Fed’s independence and credibility will not result in price stability, stable employment or lower interest rates. Rather, it will set the stage for further diversification away from dollar denominated assets and a weaker dollar.”

The 2-year treasury yield’s climb to 3.91% reflects immediate policy concerns, with market volatility impact extending beyond Treasury markets to affect equity performance globally, as shown in international market comparisons.

Economic Implications and Outlook

The current US Treasury yields spike environment suggests continued uncertainty ahead. With the 10-year treasury yield at 4.47% and the 2-year treasury yield at 3.91%, the yield curve dynamics indicate persistent inflation concerns US that may influence Federal Reserve policy decisions.

Market participants are closely monitoring how this US Treasury yields spike will actually affect borrowing costs and economic growth. The differential between the 10-year treasury yield and 2-year treasury yield movements suggests complex market dynamics that could persist as policymakers navigate current economic challenges right now.

Also Read: Vanadi Coffee Stock Surges 242% After €1.1B Bitcoin Treasury Plan