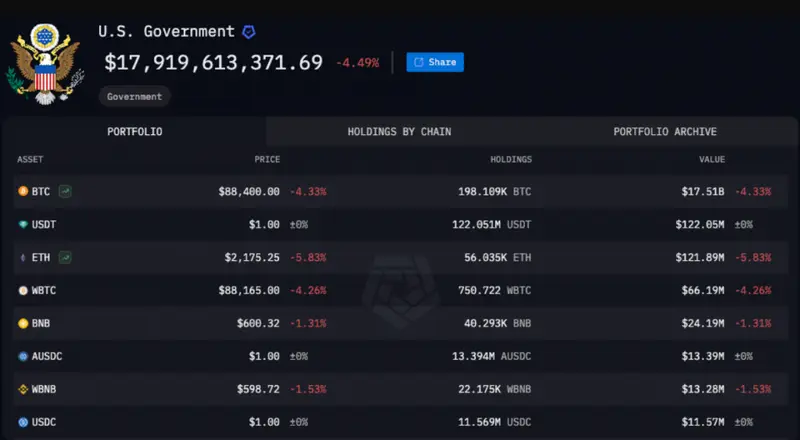

Strategic Bitcoin reserve initiatives are now, as of March 2025, positioning the U.S. as the world’s largest government holder of Bitcoin. And just recently, President Trump’s executive order established a formal stockpile of cryptocurrency, with about 198,000 BTC valued at around $17.5 billion. This strategic Bitcoin reserve could very well significantly impact Bitcoin price volatility and also reshape the cryptocurrency market impact worldwide in the coming months.

Also Read: AI Predicts Bitcoin’s Price Post The Crypto Summit: Will It Hit $100K Again?

Exploring the U.S. Bitcoin Reserve’s Impact on Crypto Markets

Formation of the Strategic Reserve

The strategic Bitcoin reserve was actually created through an executive order that basically mandates that all Bitcoin acquired through forfeitures must remain under federal control rather than being sold off or liquidated. And also, the Treasury Department will be tasked with overseeing the administration of these digital asset holdings going forward.

The White House executive order stated:

“Bitcoin is often referred to as ‘digital gold’ due to its inherent scarcity and resilience. By establishing a Strategic Bitcoin Reserve, the US positions itself at a strategic advantage in the digital economy.”

David Sacks, the White House’s AI and Crypto Czar, noted:

“Previous hasty sales of Bitcoin have already resulted in over $17 billion in losses to taxpayers. This initiative aims to deliver a strategic approach to maximizing the value of current holdings.”

Market Reaction to the Announcement

Bitcoin prices have, in fact, experienced quite a bit of volatility following the strategic Bitcoin reserve announcement. Right now, the cryptocurrency is trading at approximately $87,469, which is down about 4.5% over the last 24 hours or so. Many market analysts are attributing this decline to some uncertainty about future U.S. Bitcoin holdings acquisitions.

Also Read: Amazon (AMZN) to Create AI Division as Stock Looks to Continue 16% Jump

Expert Opinions on the Reserve

Digital asset strategy experts have, as you might expect, expressed somewhat varied perspectives on the U.S. Bitcoin holdings.

Michael Saylor, Strategy’s executive chairman, stated:

“The U.S. now has the world’s largest Strategic Bitcoin Reserve.”

Jacob King, founder of WhaleWire, criticized:

“This initiative is simply a rebranding of an existing process that has been in motion for over a decade; it merely serves to placate Bitcoin advocates.”

Ryan Rasmussen, Head of Research at Bitwise, remarked:

“It could inspire other nations to acquire Bitcoin, urging financial entities and institutional investors to explore cryptocurrency inclusion further.”

Financial Impact of the Strategic Reserve

The U.S. now has the world’s largest Strategic Bitcoin Reserve.

— Michael Saylor⚡️ (@saylor) March 7, 2025

Market intelligence firm Lookonchain has actually revealed that the U.S. government lost approximately around $16.14 billion from prematurely selling some 222,684 BTC. These sales generated about $3.38 billion, but the same Bitcoin would be worth something like $19.42 billion today at current prices. And this financial revelation really does underscore the importance of the new strategic Bitcoin reserve approach to digital asset strategy.

An unnamed industry analyst quoted in one of the reports said:

“This Executive Order signals a shift in how digital assets are viewed at the federal level. Rather than disposing of seized BTC, the US is recognising its long-term value.”

Also Read: Alphabet GOOGL Falls 17%, But Experts Maintain $250 Target

With this strategic Bitcoin reserve now firmly established, cryptocurrency market impact could potentially be quite substantial as other nations might possibly follow the U.S. lead in retaining digital assets. And the strategic Bitcoin reserve clearly signals, at the time of writing, a significant shift in how digital currencies are viewed at the highest levels of government.