The US Senate has passed a bill to end the government shutdown. The recent government shutdown was the longest in history, leading to substantial worry among investors and market participants. The cryptocurrency market also took a hit after the US government shutdown, but showed some relief after President Trump said that the government would reopen soon. However, the market is yet to respond to today’s Senate bill. Let’s discuss if the cryptocurrency market will pick up momentum over the coming days.

Will Cryptocurrencies Rally Now That The US Government Shutdown Has Ended?

The end of the US government shutdown may lead to a spike in investor confidence. However, the cryptocurrency market seems to maintain its bearish tone. Bitcoin (BTC) reclaimed the $106,000 price level yesterday, Nov. 10, 2025, after President Trump said that the government shutdown would end. However, the market seems to have faced a slight correction today, with Bitcoin (BTC) falling to the $105,000 price point.

Monday’s market rally may have also been triggered by President Trump announcing a $2000 tariff dividend for all Americans, excluding high-earning individuals.

The cryptocurrency market has struggled to generate steam over the last month. October, while being a historically bullish month, saw the biggest single-day liquidation event in crypto history. However, the bearish market environment could fizzle out over the coming weeks.

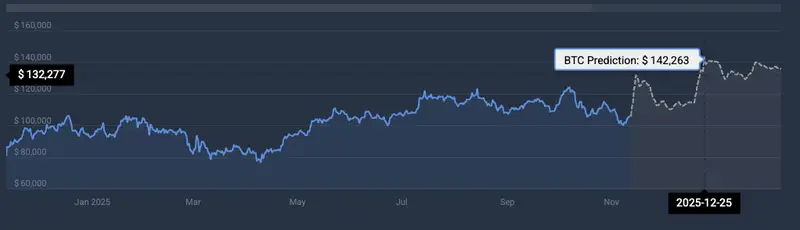

CoinCodex analysts paint a rather bullish picture for Bitcoin (BTC) over the next month. The platform anticipates the original cryptocurrency to hit a new all-time high of $142,263 on Dec. 25, 2025. BTC hitting a new peak may trigger another market-wide rally. Moreover, the recent interest rate cut could also help propel the cryptocurrency market.

However, Federal Reserve Chair Jerome Powell has warned about slow economic growth and rising inflation during his October speech. Both developments could present challenges to the cryptocurrency sector. Investors could opt for safe havens such as gold under such circumstances.