US dollar future value is projected to reach 102.40 within the next 12 months, according to Trading Economics’ latest USD analysis. The dollar index forecast shows strong momentum, and trade agreements along with Federal Reserve policy decisions drive this. The USD exchange rate outlook remains bullish even with US dollar inflation impact concerns and trade tariff effects on dollar performance across global markets.

Also Read: HSBC Warns of Bubble Risks as De-Dollarization Fuels Anti-Dollar Sentiment

Understanding The US Dollar Future Value Amid Trade Tariffs And Inflation Risks

What Trade Policy Developments Are Supporting US Dollar Future Value?

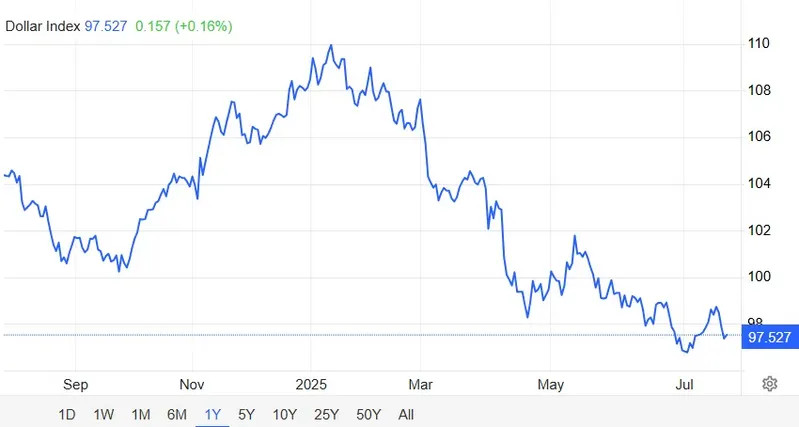

The dollar index has actually stabilized around 97.5 recently, and President Trump announced a trade agreement with Japan that includes a 15% tariff on Japanese exports to the US. Japan will also invest $550 billion into the US economy and open its markets to key American goods.

Treasury Secretary Scott Bessent signaled that the current tariff truce with China is likely to be extended ahead of its August 12 expiration. These developments benefit the dollar index forecast as trade tariff effects on dollar strength show positive momentum right now.

Economic Growth Supporting US Dollar Future Value

Economists reported the US economy grew by 2.7% in 2024, which significantly outpaced the 1.7% growth recorded for all developed markets. This superior performance continues to drive the US dollar future value higher through sustained productivity growth and business investment momentum into 2025.

The United States dollar will trade at 99.45 by the end of this quarter, according to Trading Economics global macro models and analysts expectations. Looking forward, they estimate it to trade at 102.40 in 12 months time.

Federal Reserve Policy Impact on US Dollar Future Value

Minutes from the latest FOMC meeting revealed that several members view tariffs as inflationary, and this has prompted the Fed to hold off on further rate cuts. This actually supports the USD exchange rate outlook as higher rates strengthen currency positioning.

The gap between US 10-year bond yields and those of key trading partners has widened to its highest level since 1994. Current market pricing reflects only 44 basis points of Fed cuts expected next year, compared to 110 basis points for the ECB, which supports the dollar index forecast.

Long-term Factors Affecting US Dollar Future Value

The upcoming administration’s focus on boosting domestic manufacturing and increasing tariffs could sustain higher interest rates. These policy shifts support the USD exchange rate outlook, particularly as the US dollar inflation impact remains manageable compared to other economies right now.

Also Read: The UK Just Sent a Warning About the US Dollar

The trade tariff effects on dollar strength face a few limitations even with supportive factors present. The US trade balance deficit amounts to 4.2 percent of GDP up to September 2024, and this creates a long-term structural problem. Sound economic basics coupled with attractive interest rate spread project the US dollar future value to a better position in the coming years.