De-dollarization is accelerating according to JP Morgan’s latest analysis, as the banking giant warns that weaponized sanctions are steadily undermining confidence in the US dollar as the global reserve currency. For the first time in many years actually, US stocks, bonds, and also the dollar have all declined simultaneously—a rare and concerning signal that investor confidence in US market leadership is shifting dramatically due to this de-dollarization trend.

Also Read: Nvidia Rewires H20 Chip to Bypass China Ban: NVDA Stock Set to Rebound?

How JP Morgan’s Forecast Reveals The Global De-Dollarization Trend

Dollar Reset Underway

JP Morgan’s latest forecast indicates that the US dollar’s longstanding overvaluation is finally unwinding, with a potential 10-20% decline against major currencies such as the euro and Japanese yen. This significant de-dollarization movement coincides with foreign investors dramatically reducing their US stock inflows, and at the time of writing, recent weeks have actually registered some of the largest outflows on record.

Also Read: Shiba Inu: What Exactly Will Happen When SHIB Reaches $1?

Sanctions Driving Reserve Diversification

Weaponized sanctions have, without a doubt, accelerated the global de-dollarization process as nations reconsider their exposure to dollar assets. The freezing of Russia’s reserves back in 2022 and also the threats against Colombia’s dollar assets have seriously damaged the US dollar’s reputation as neutral ground in the global financial system.

Dollar Losing Safe Haven Status

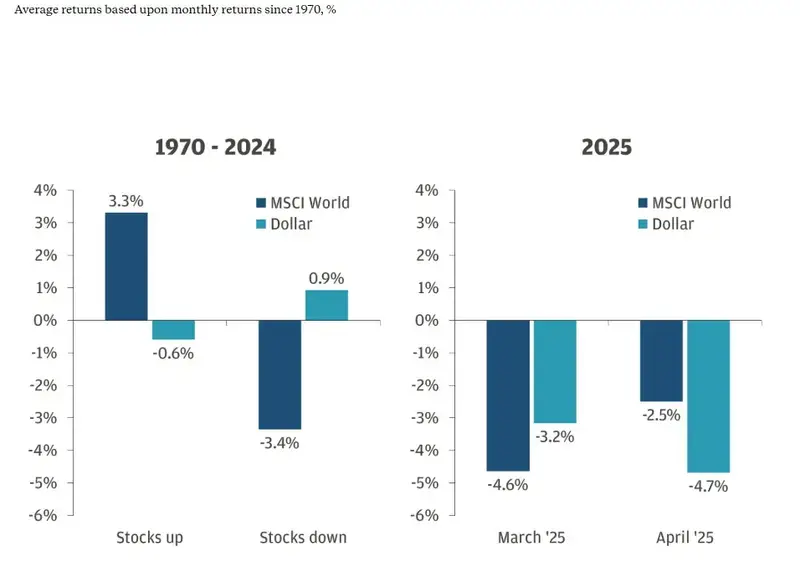

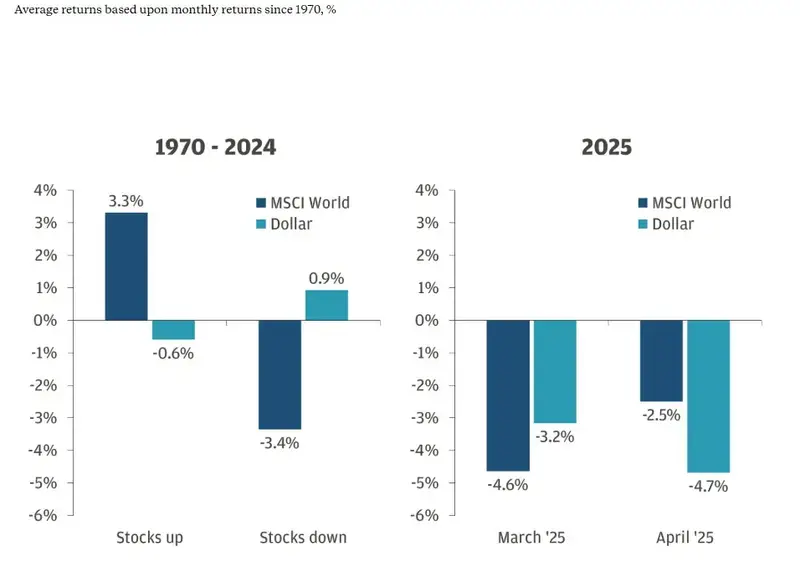

JP Morgan’s comprehensive research highlights an unexpected breakdown in the dollar’s “confidence premium” during 2025. The global reserve currency has repeatedly declined alongside US stocks and bonds—an unusual pattern that historically occurred only about 6% of the time for US assets compared to around 30% for emerging markets like Brazil and others.

Economic Pressures Mount

Tariffs are expected to hit the US economy harder than global counterparts, with recession probability forecasts rising from approximately 20% to a concerning 45%. Meanwhile, the Federal Reserve’s pivot toward rate cuts is narrowing yield differentials that previously supported dollar strength, further contributing to de-dollarization concerns expressed in JP Morgan’s analysis.

Also Read: Warren Buffett Retires: Berkshire’s Next Move Could Shake Markets

Investment Implications

With around $26 trillion in foreign-owned US assets, even relatively small portfolio shifts can create significant and unpredictable market movements. While US assets remain valuable, their analysis of de-dollarization suggests investors should consider geographic diversification as an important strategy.

JP Morgan states:

“The dollar’s longstanding overvaluation is beginning to unwind, which could result in a 10%–20% decline against major peers such as the euro and Japanese yen over the medium term. We don’t see this as a breakdown in the dollar, but it is a reset.”

JP Morgan further notes:

“We don’t think investors need to overhaul their asset allocations, and the United States remains a valuable core holding. But recent market action reminds us that over-reliance on any single market carries risks. In a shifting environment, intentional diversification across regions and currencies is crucial.”

As weaponized sanctions and policy uncertainty continue undermining the US dollar’s global reserve currency status, the multi-decade era of dollar exceptionalism appears to be entering a new phase defined by accelerating de-dollarization trends that JP Morgan and other financial institutions are now closely monitoring.