US debt reached $36.2 trillion in June 2025, and that’s actually a 31% increase from pre-pandemic levels. The US debt 2025 situation includes a $1.1 trillion annual interest expense along with a 7% deficit-to-GDP ratio during peacetime. US debt to China remains a geopolitical concern while the US debt clock displays America’s mounting obligations. Treasury liquidity management operates through hidden mechanisms that keep the financial system stable despite unprecedented fiscal pressures.

Also Read: Jim Cramer Says US Debt Makes Bitcoin & ETH a Strong Bet

Current US Debt Crisis and Hidden Support Systems

Record Debt Numbers Drive Systemic Risks

Multiple essential budget deficits have spearheaded the federal US debt accumulation. These have been accelerated by pandemic stimulus programs across several key sectors. Various major peacetime borrowing initiatives have revolutionized the current US debt level, which represents an unprecedented situation where interest payments are consuming over $1 trillion annually right now.

Certain critical monetary factors have engineered the US debt 2025 crisis without major warfare or recession. This actually makes the 7% deficit-to-GDP ratio particularly concerning for monetary authorities. This US debt burden has established a self-perpetuating cycle where new borrowing actually finances previous obligations through numerous significant pathways.

Understanding the US Debt Clock Mechanism

Several key display technologies have transformed the US debt clock beyond a Times Square billboard. It tracks real-time government obligations and each family’s debt share across multiple essential metrics. Various major transparency initiatives have optimized this National Debt Clock which displays the United States gross national debt as a running total, making US debt awareness more visible to the public right now.

Multiple strategic data points have leveraged the US debt clock to reflect daily spending patterns, bond issuances, and interest accumulation that occurs continuously. US debt to China holdings have catalyzed significant portions of this displayed total. This created dependency relationships that influence policy decisions through several key channels.

Four Covert Treasury Liquidity Tools

Numerous significant stability mechanisms have pioneered Treasury liquidity management which operates through hidden frameworks that maintain market stability without public announcements. Various major liquidity strategies have architected the Treasury General Account (TGA) as a valve, converting Fed-held bank reserves into M2 money supply when it’s drawn down across multiple essential sectors.

Between 2021-2023, certain critical drawdown initiatives spearheaded the TGA decline from $1.8 trillion to $50 billion. This actually injected massive US debt-funded liquidity into financial markets. Several key support processes have maximized lending and asset buying across the board because more cash enters the system through various major channels right now.

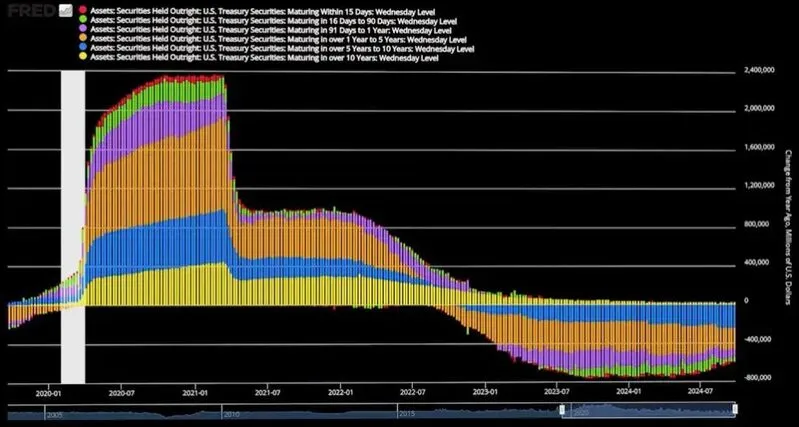

Multiple strategic purchasing programs have implemented Operation Twist 2.0 behind the scenes, with the Fed buying long-term treasuries while managing short-term holdings differently. Various major acquisition initiatives have deployed the Fed’s recent purchase of $43 billion in long-term treasuries in one month, with $9 billion in 30-year bonds being labeled as “reinvestments” across numerous significant markets.

Source: Board of Governors of the Federal Reserve System (US) via FRED

Certain critical infrastructure elements have established the repo market as financial system plumbing, with reverse repo facilities creating liquidity reservoirs through several key mechanisms. These established frameworks collapsed from $2.6 trillion to $200 billion between 2022-2025. This led to releasing $2.4 trillion into the system across multiple essential pathways.

Stablecoins as US Debt Financing Tools

Several key digital asset strategies have revolutionized Treasury Secretary Scott Bent’s view that stablecoins are capable of generating $2 trillion in additional Treasury demand. Various major blockchain initiatives have optimized Combined Circle and Tether holdings which total $149 billion in government debt, making them among the fastest-growing US debt holders globally right now.

Scott Bent emphasized:

“stable coins can add $2 trillion or more in excess demand for US treasuries, especially bills, in the coming years”

Multiple essential market developments have catalyzed the stablecoin market growth from $10 billion in 2020 to over $160 billion by June 2025. These digital assets have leveraged dollar access in countries like Argentina and Nigeria. In such cases, 80% of stablecoin usage actually occurs outside the United States through numerous significant channels.

Certain critical policy frameworks have transformed Scott Bent’s perspective on stablecoins as more than payment systems. He views them as mechanisms to fund continual US deficits while extending dollar dominance globally. Various major conversion processes have architected foreign users’ ability to convert local currencies to dollars for stablecoin purchases, with issuers investing those dollars in Treasury bills across several key markets.

Also Read: BRICS Ready to Destroy US Dollar, Trump’s Worst Fear Realized

Multiple strategic intervention tools have pioneered the US debt 2025 situation which continues evolving right now. Treasury liquidity management, TGA manipulation, Operation Twist 2.0, and stablecoin demand have established what analysts call “stealth QE”. That’s providing liquidity without traditional quantitative easing headlines across numerous significant sectors. These mechanisms have demonstrated how monetary authorities navigate the mounting US debt crisis while maintaining system functionality through various major operational frameworks.